About Pathwise

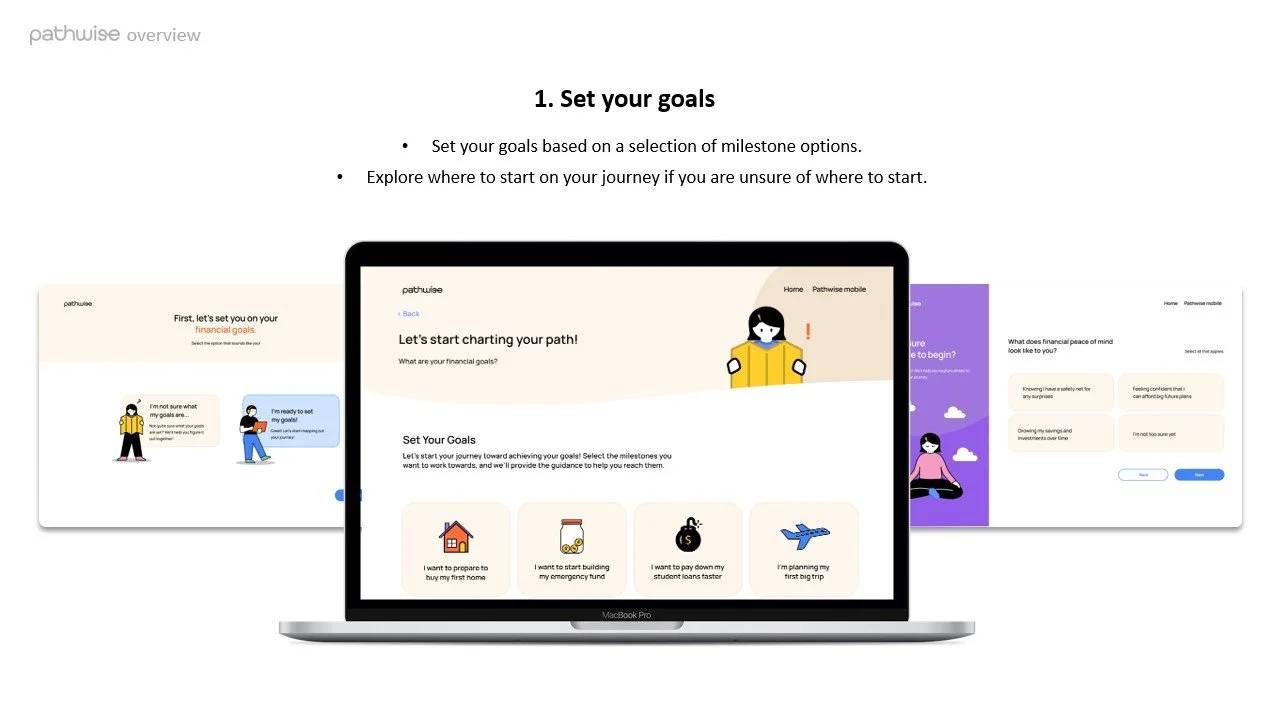

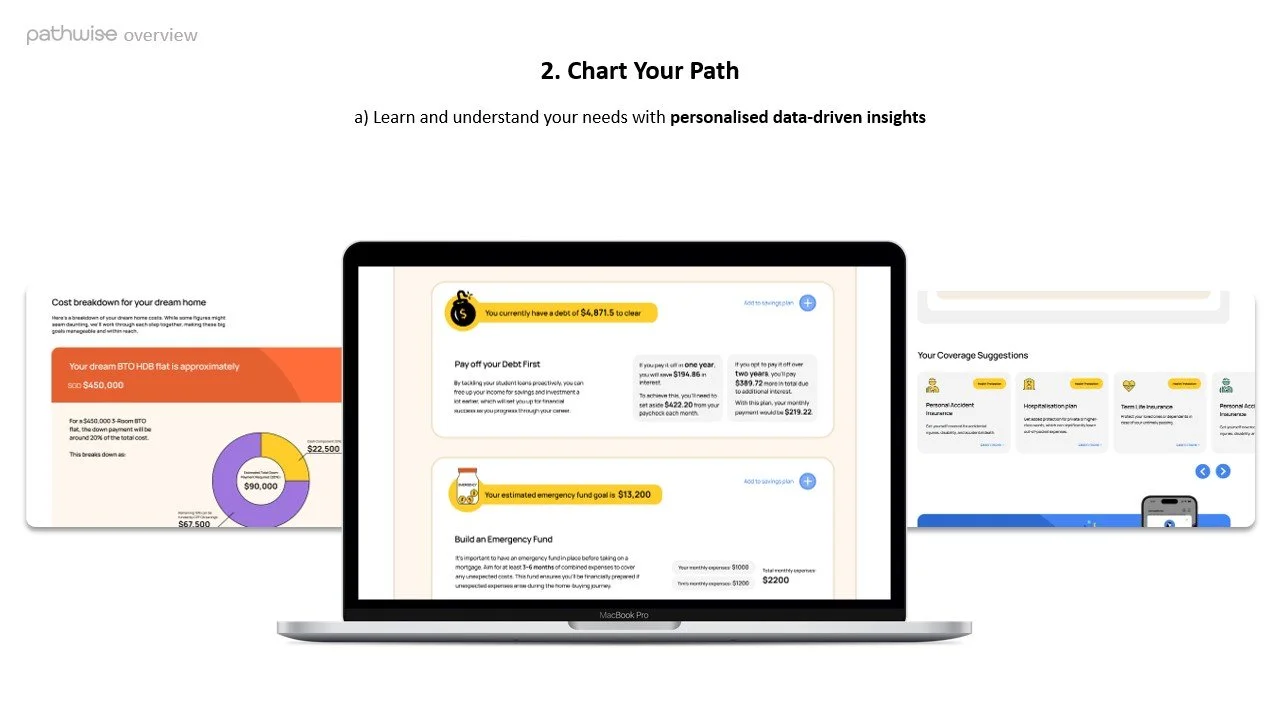

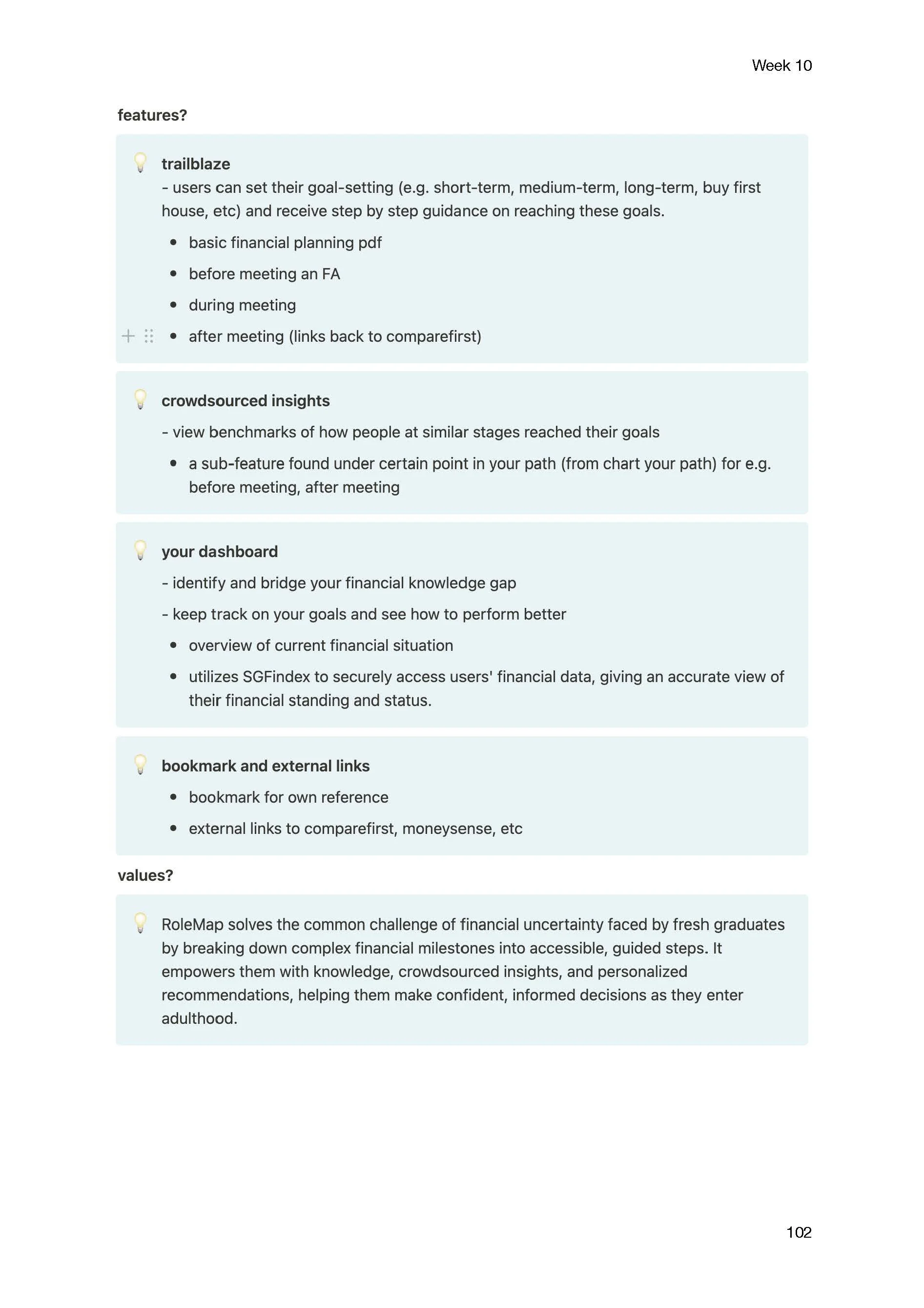

Pathwise is an online platform that helps young adults achieve their first financial milestones by breaking down big goals into manageable steps. It offers personalized, data-driven insights to guide users in setting, tracking, and achieving financial objectives based on their current situation.

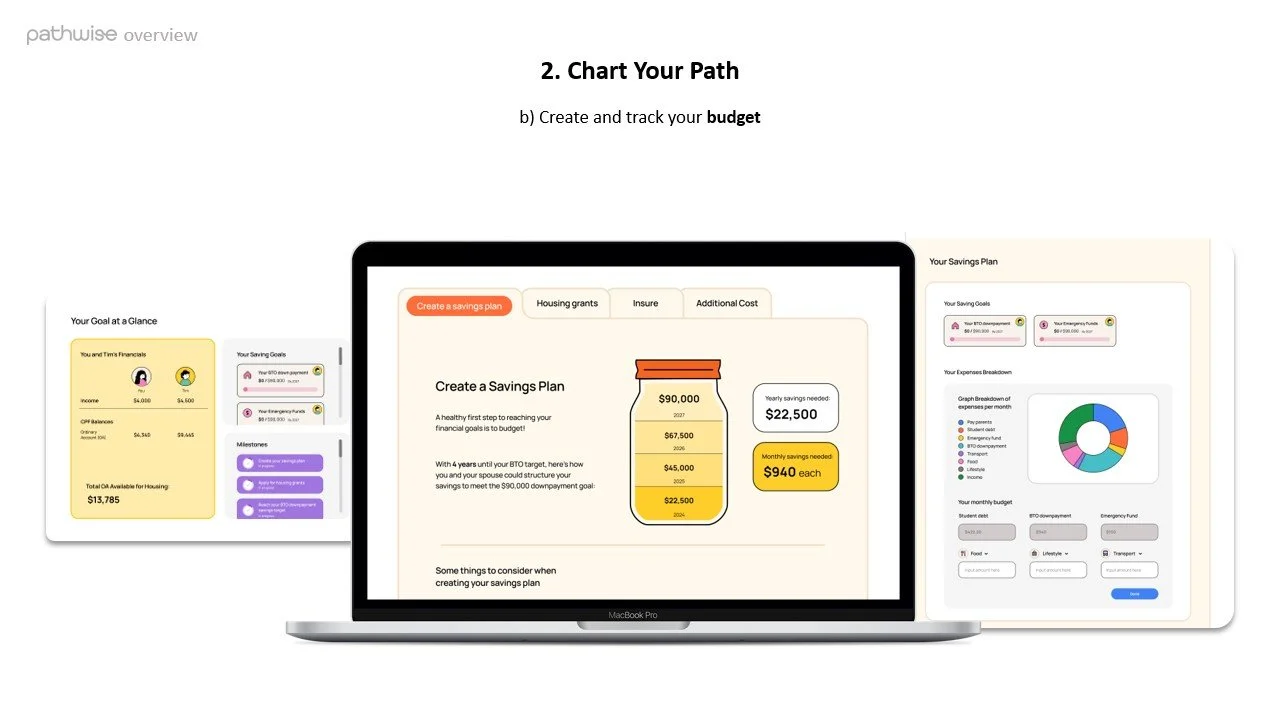

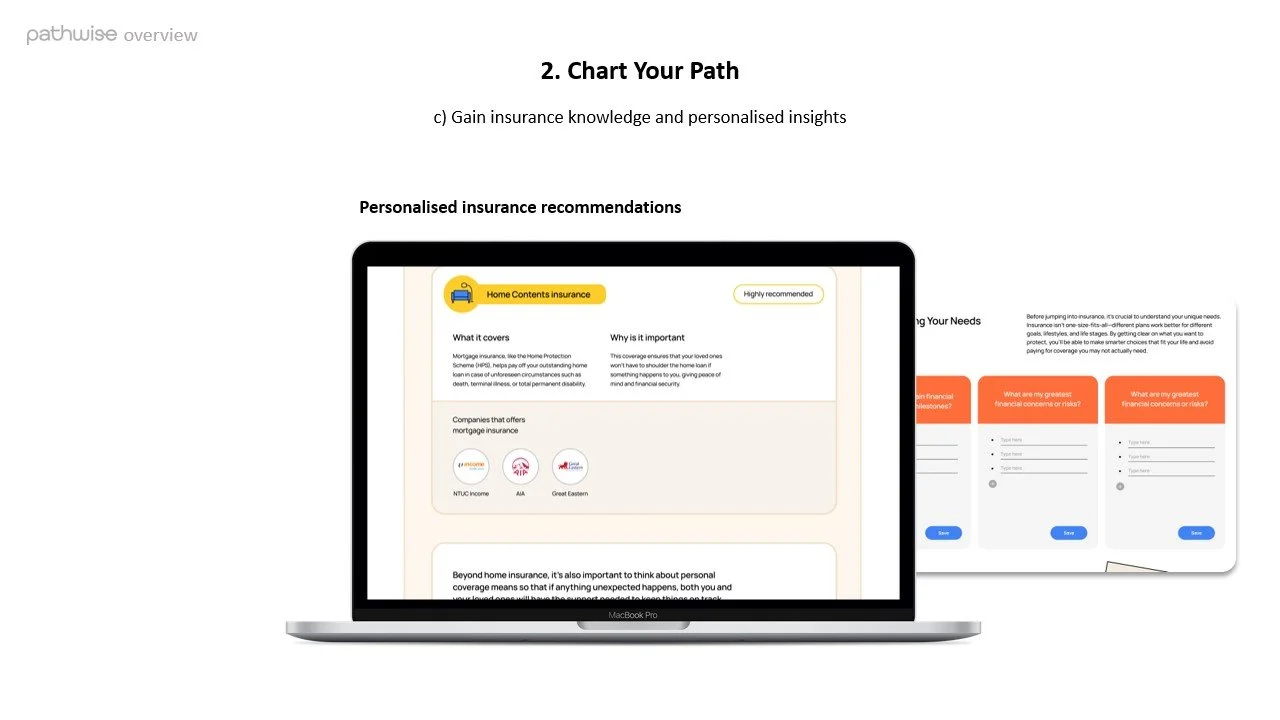

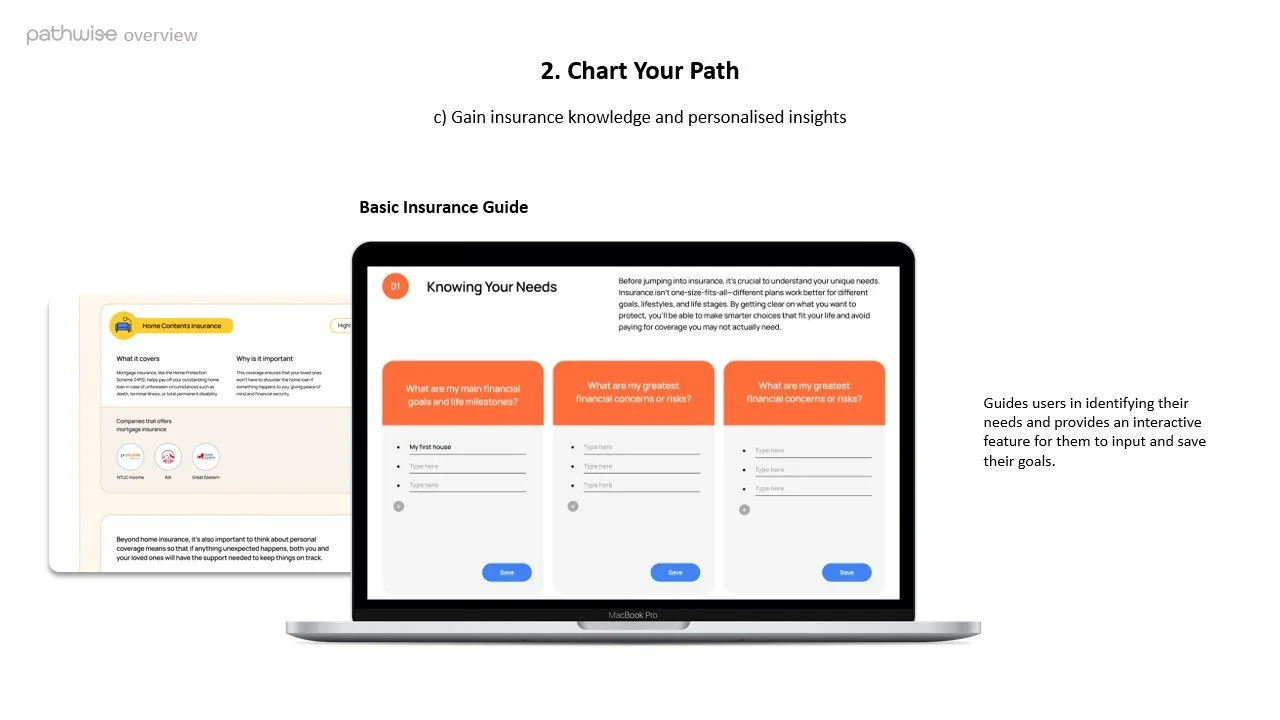

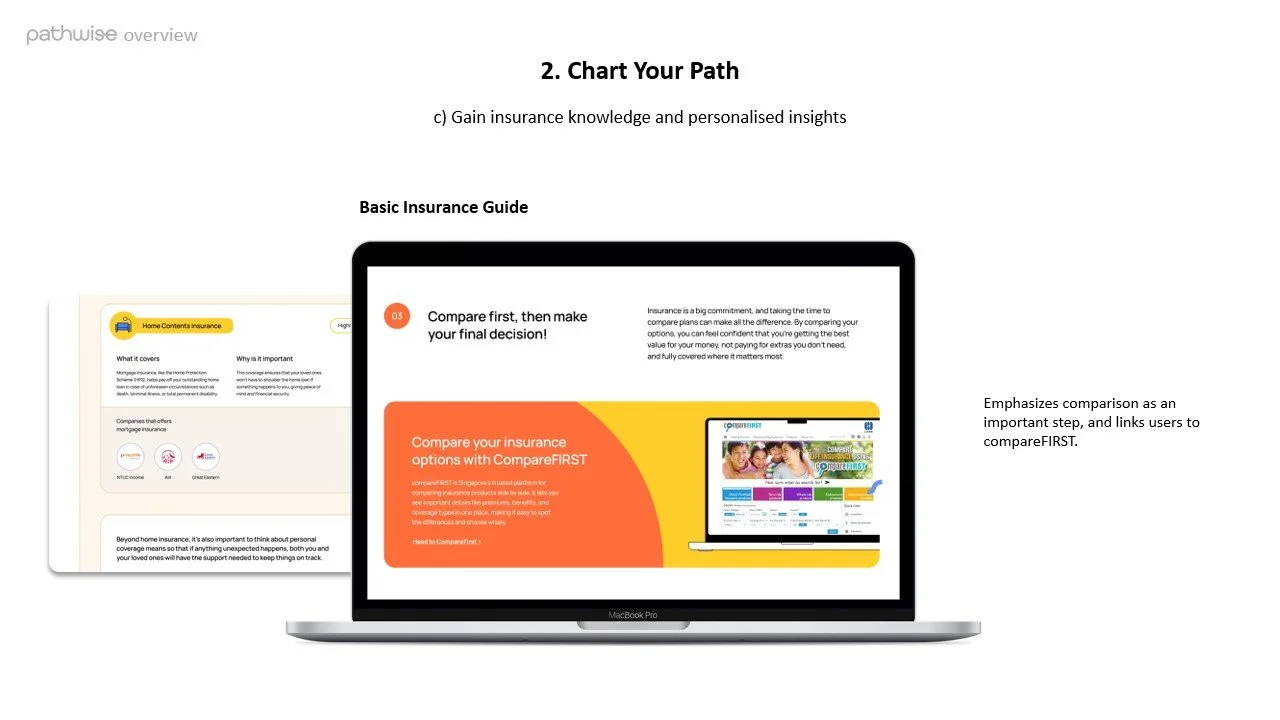

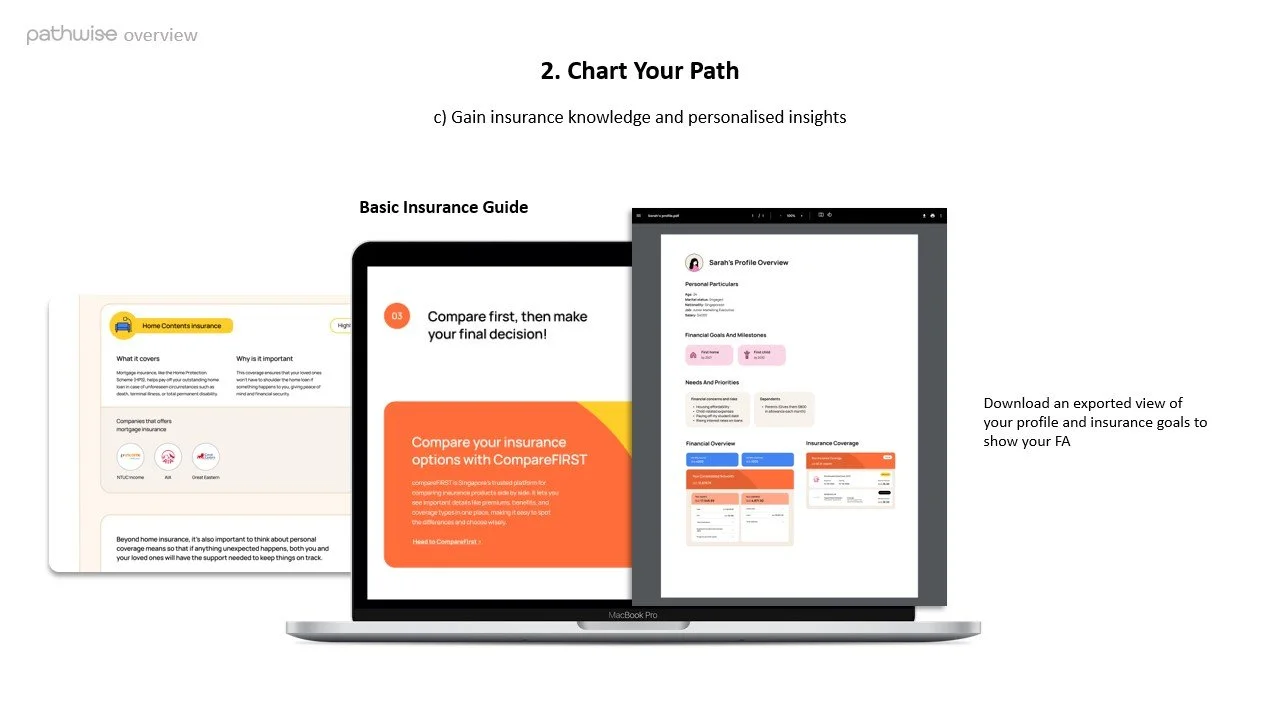

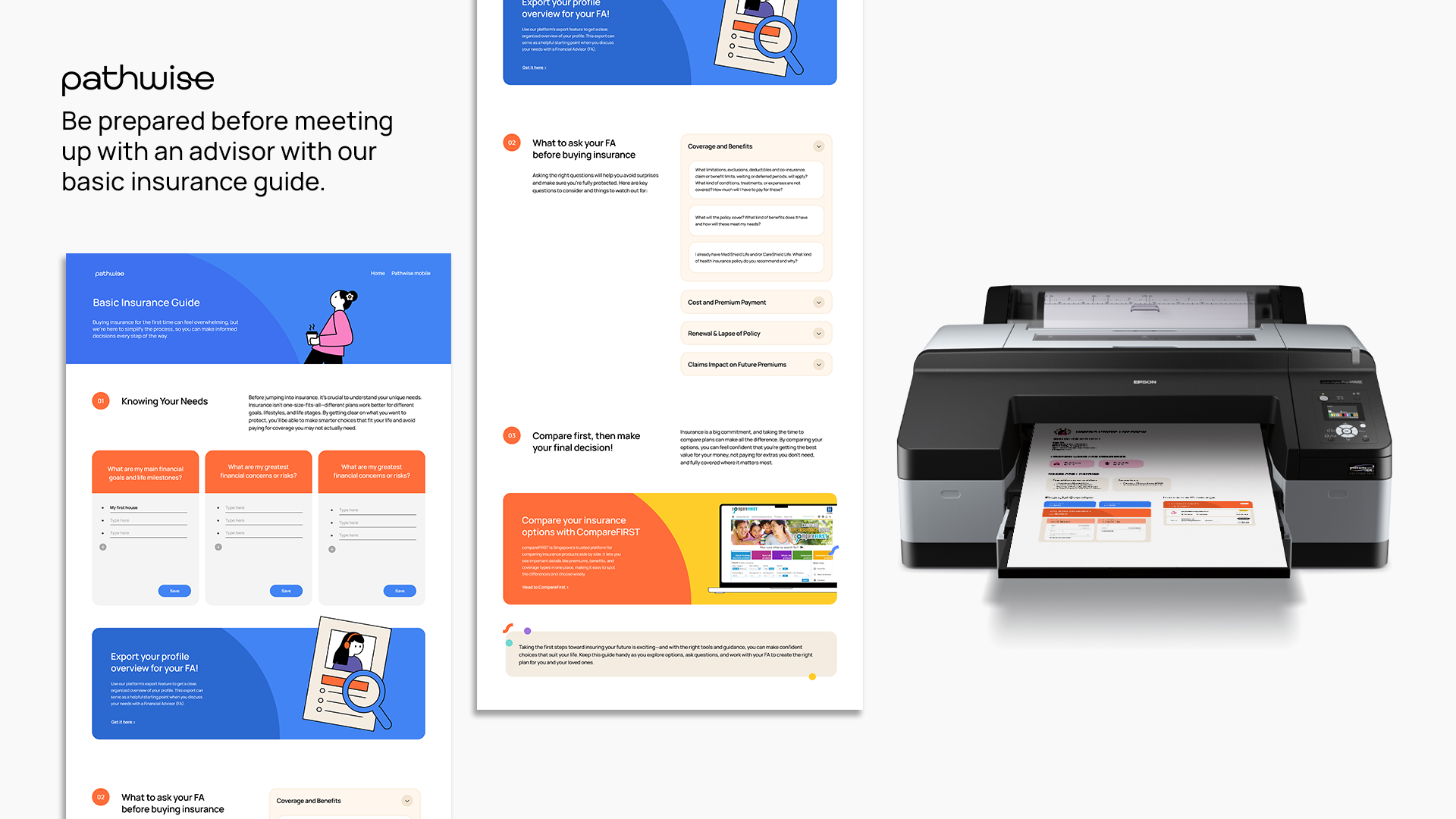

Users can create and manage budgets, ensuring financial security for both planned goals and unexpected needs. For first-time insurance buyers, Pathwise provides a basic guide and tailored insights, with easy access to CompareFirst for comparisons. Additionally, users can export their profile summary as a PDF for seamless consultations with financial advisors.

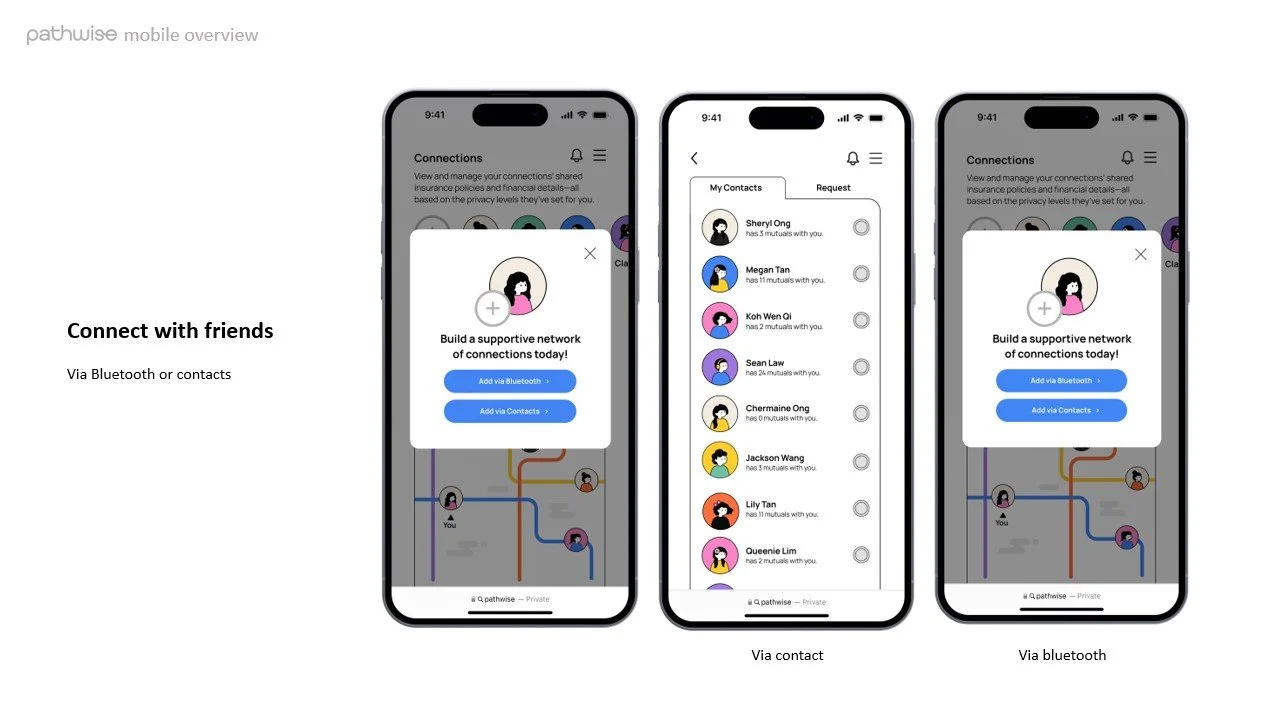

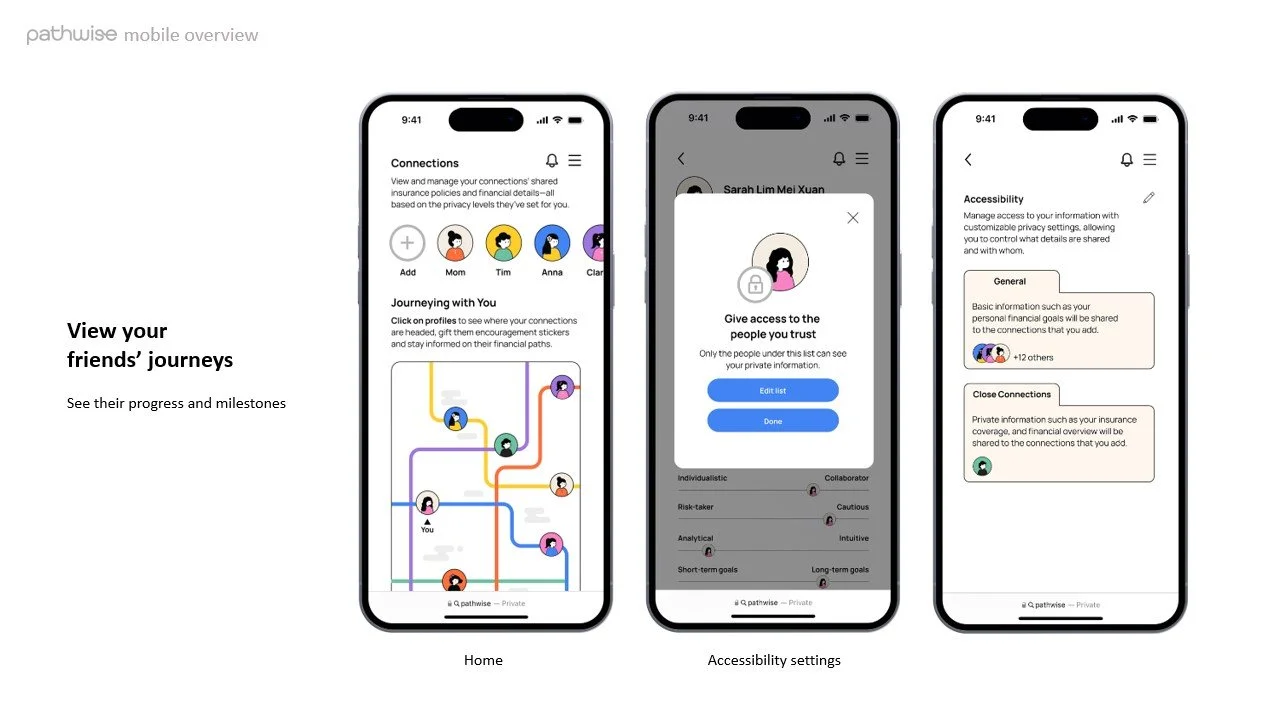

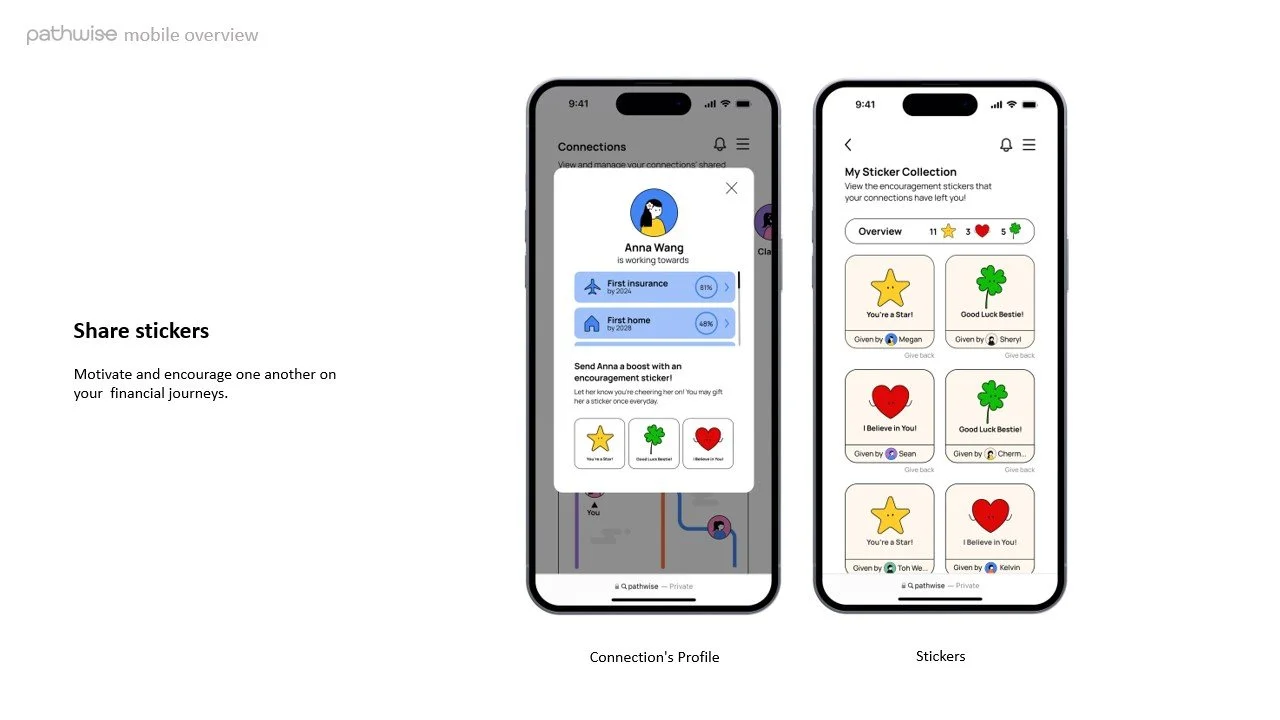

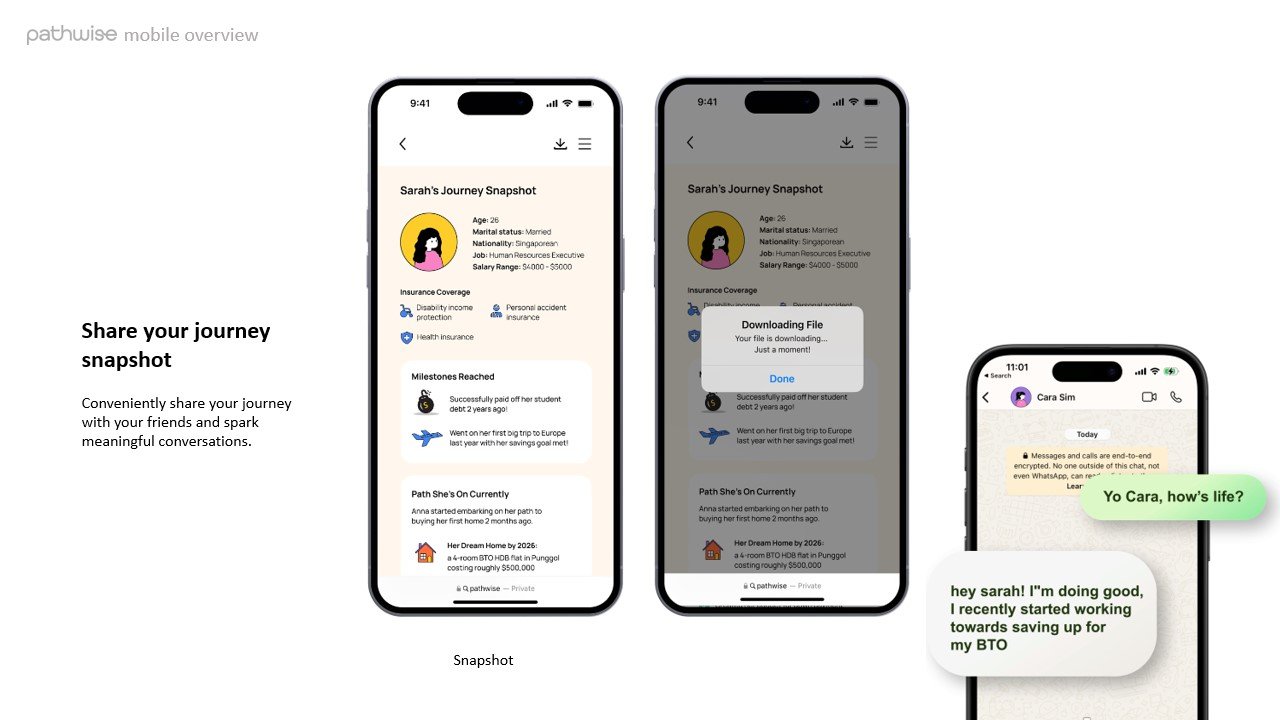

Pathwise Mobile complements the platform by offering a supportive space for friends to journey together. With a quick tap via Bluetooth or contacts, users can connect with friends, track their progress, and celebrate milestones with encouraging stickers. They can also generate a snapshot of their journey to easily share with friends, sparking meaningful conversations about their financial goals and progress.

A project done by Lim Pei Chin, Rachel Tan Qian Yi and Gerrica Eponine Tan Fei

IP bought over by MAS in May 2025

View our showreel to better understand Pathwise

Design Brief from

Monetary Authority Singapore (MAS)

Financial and digital literacy remains out of reach for many in Singapore, making it challenging for people to navigate important decisions about life insurance and investments.

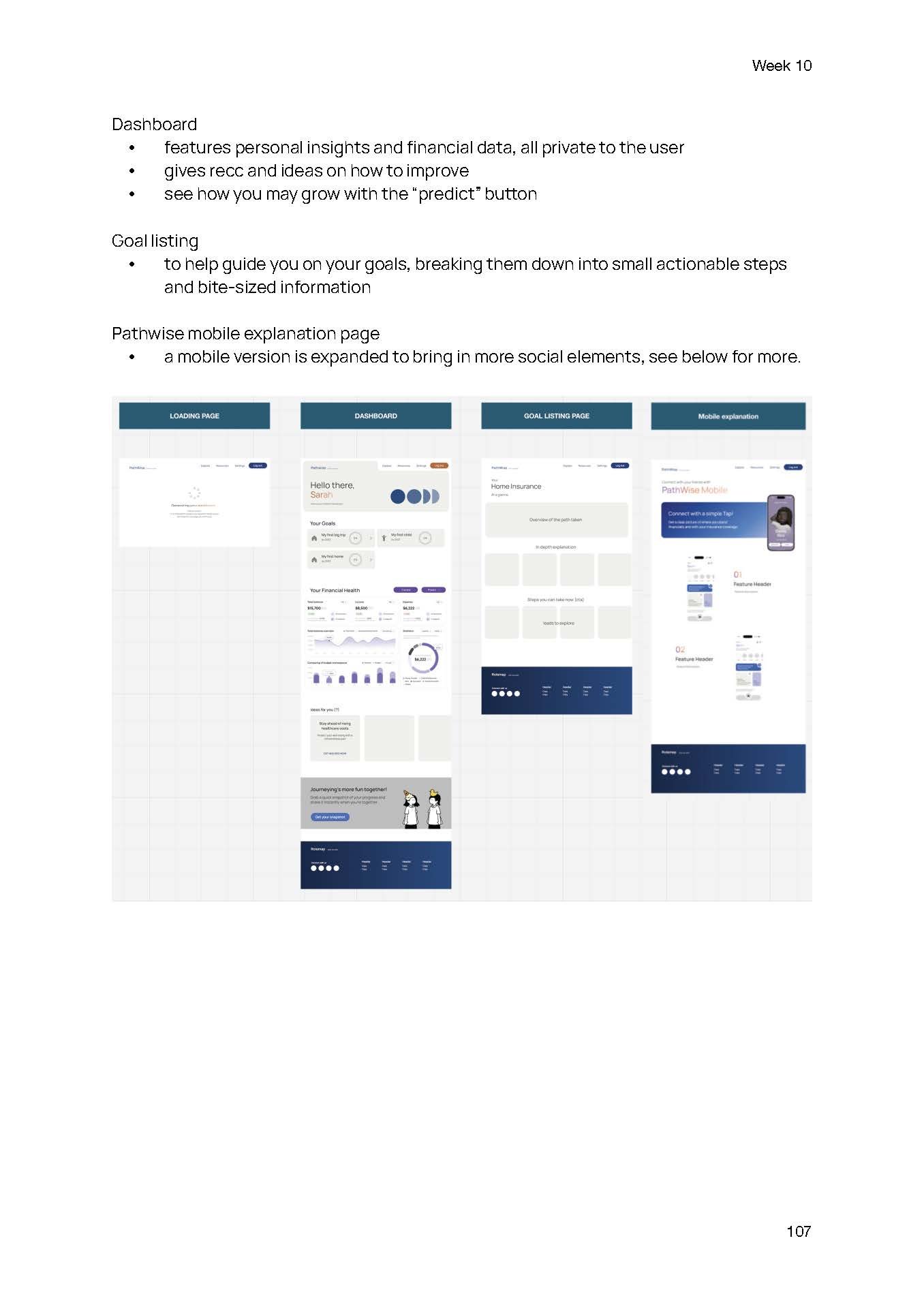

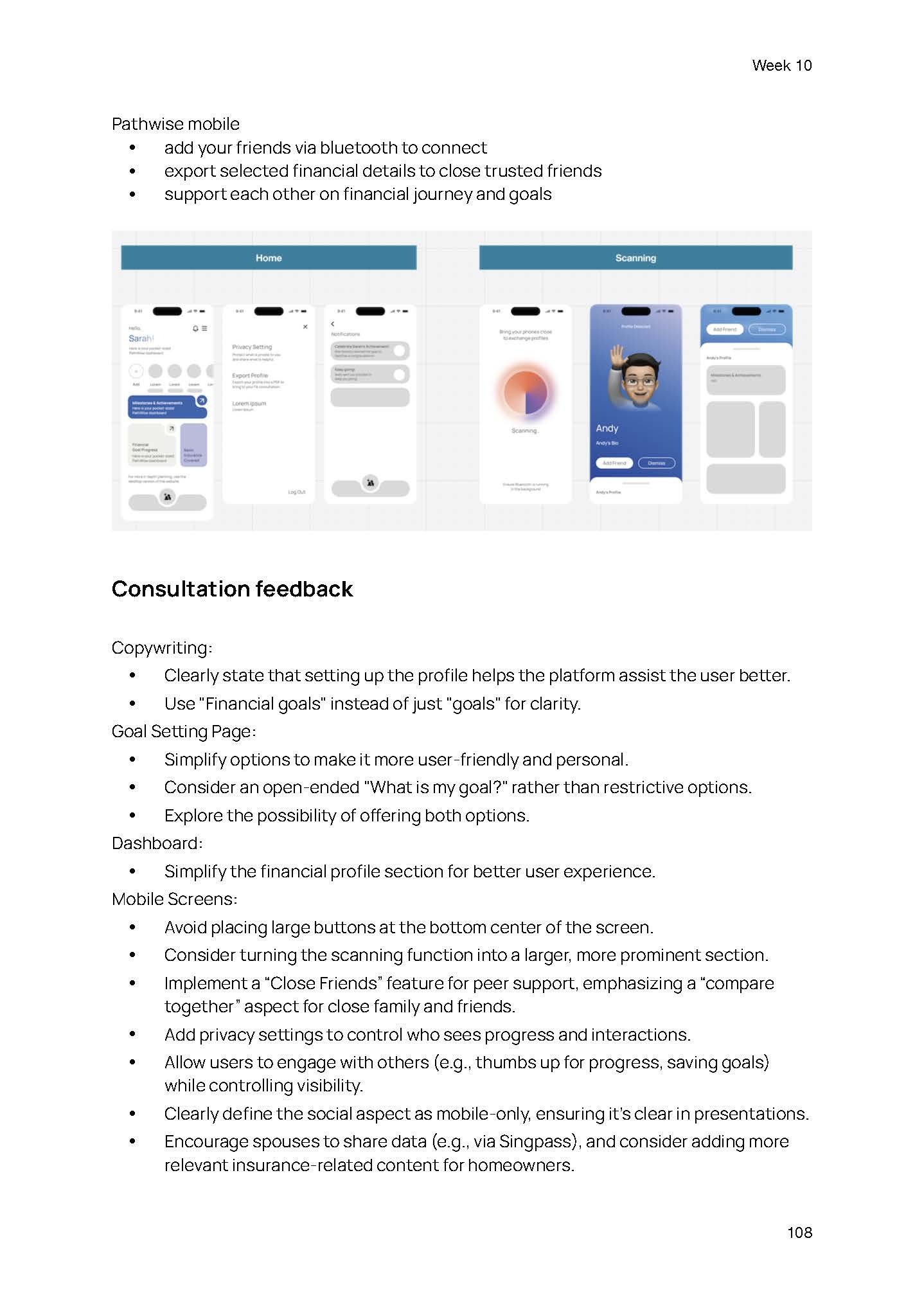

Our aim is to enhance CompareFirst, a vital government-backed tool designed to help Singaporeans compare financial products. By improving this tool, we have a unique opportunity to design a solution that truly serves the community, making financial literacy and informed decision-making accessible to everyone.

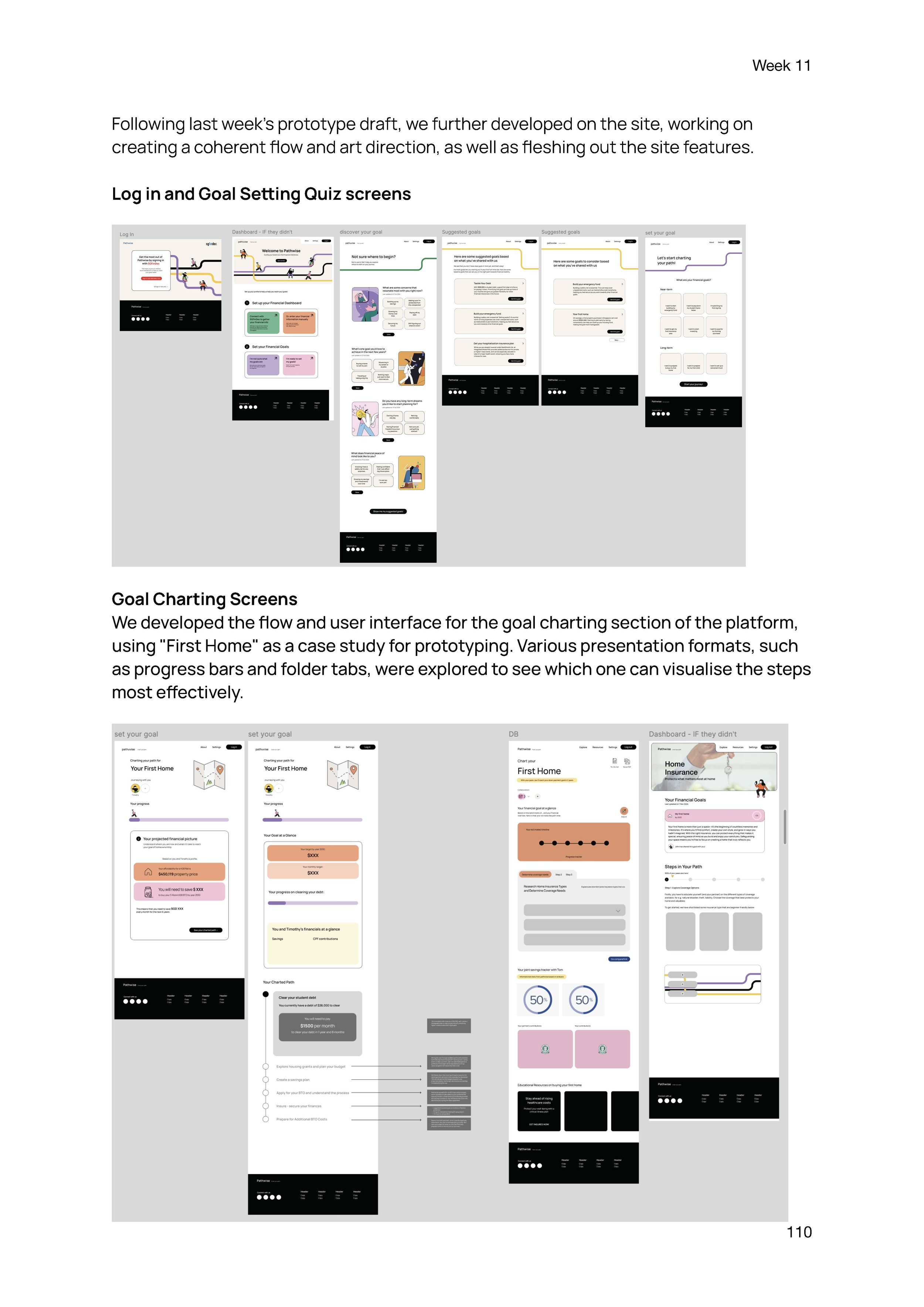

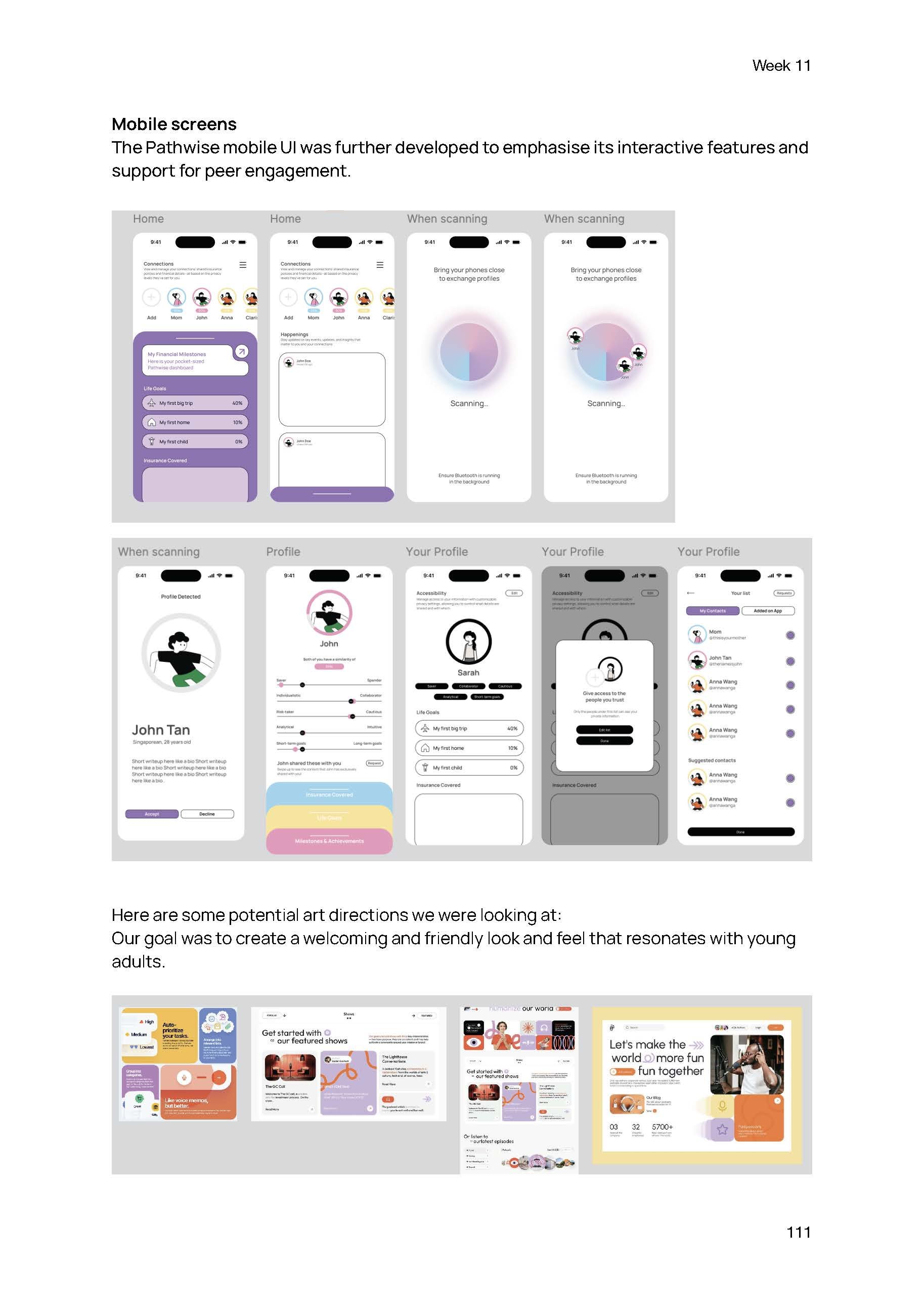

It isn’t just about improving a digital tool; it’s about empowering individuals through better design. By focusing on user-centered design, we can transform CompareFirst into a more intuitive and supportive resource, bridging gaps in financial and digital literacy. The broader impact? A more informed, confident, and financially secure community, showcasing how thoughtful design can drive social good.

The Design Process

Through 13 weeks, our team of 3 embarked on comprehensive desk research, conduct in-depth interviews with users, observe real-world interactions, participate in collaborative workshops, and create both low and high-fidelity prototypes. We performed user research, data synthesis, concept generation, prototyping, and user testing.

About CompareFirst

CompareFirst is a Singaporean website designed to help consumers compare life insurance products offered by various insurers. It allows users to compare Direct Purchase Insurance (DPI), term life, whole life, and endowment policies, as well as get general information on investment-linked products. The platform aims to empower consumers to make informed decisions about their life insurance needs by providing a centralized place to compare premiums and policy features.

Quick Summary of Pros vs Cons

One of the standout benefits of CompareFirst is its unbiased nature, offering transparent information about insurance options, which contrasts with the potential biases that can arise when customers consult with a financial advisor. Trust and transparency are central values and the selling points of CompareFirst, making it a reliable source for those seeking impartial advice.

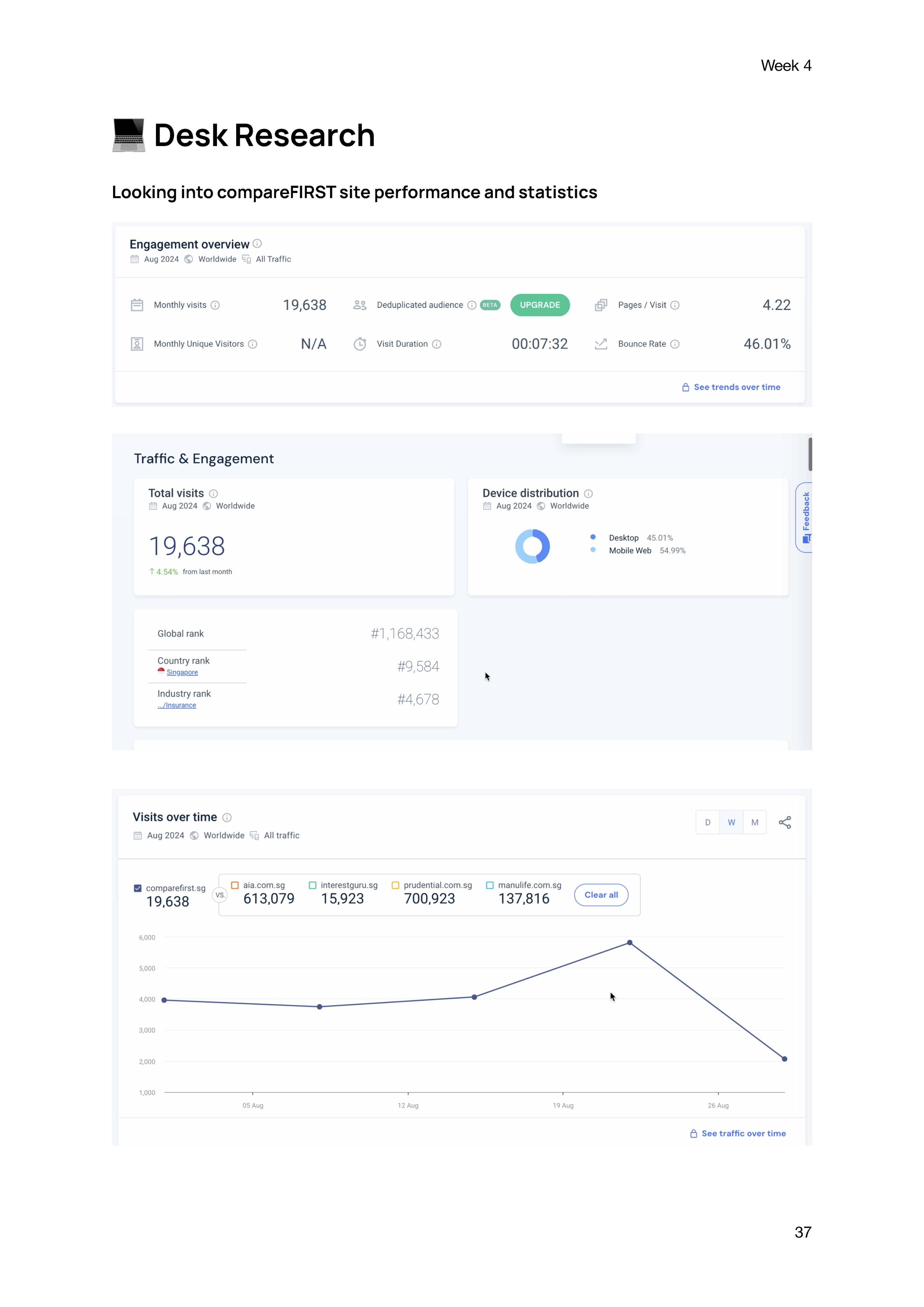

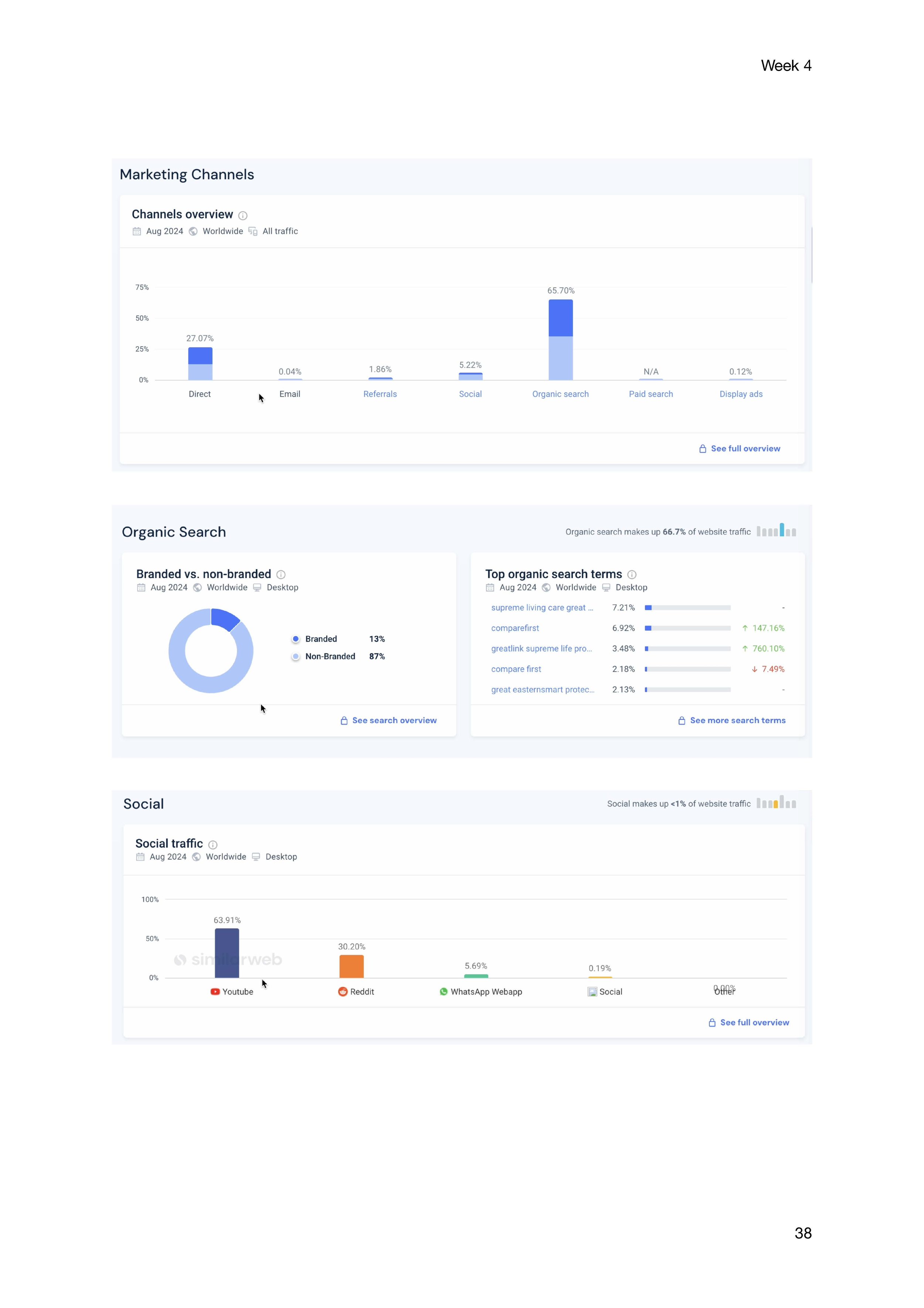

However, CompareFirst seems to cater more effectively to individuals with basic understanding of insurance. It presents a barrier of entry for those with limited knowledge. Many young adults do not know what they don’t know – which makes it challenging to navigate around the site. Moreover, through a third-party engine app, we learnt that CompareFirst lacks social traffic and engagement from its intended audience.

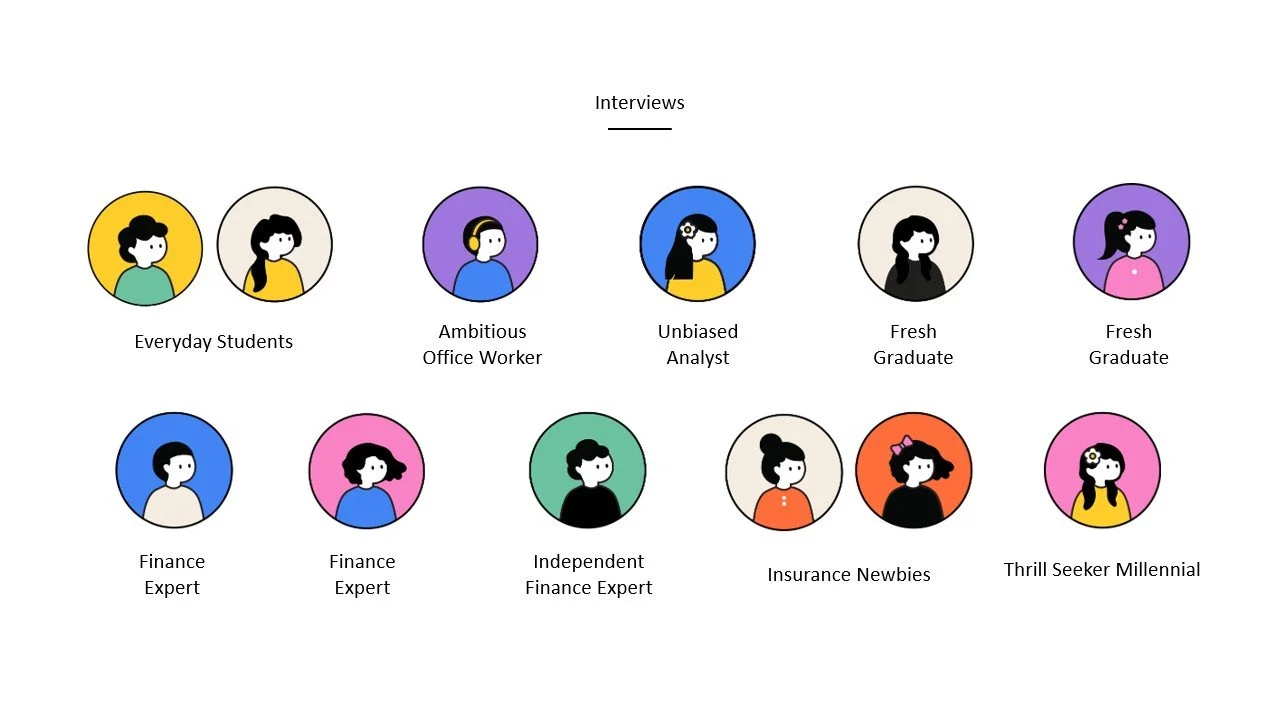

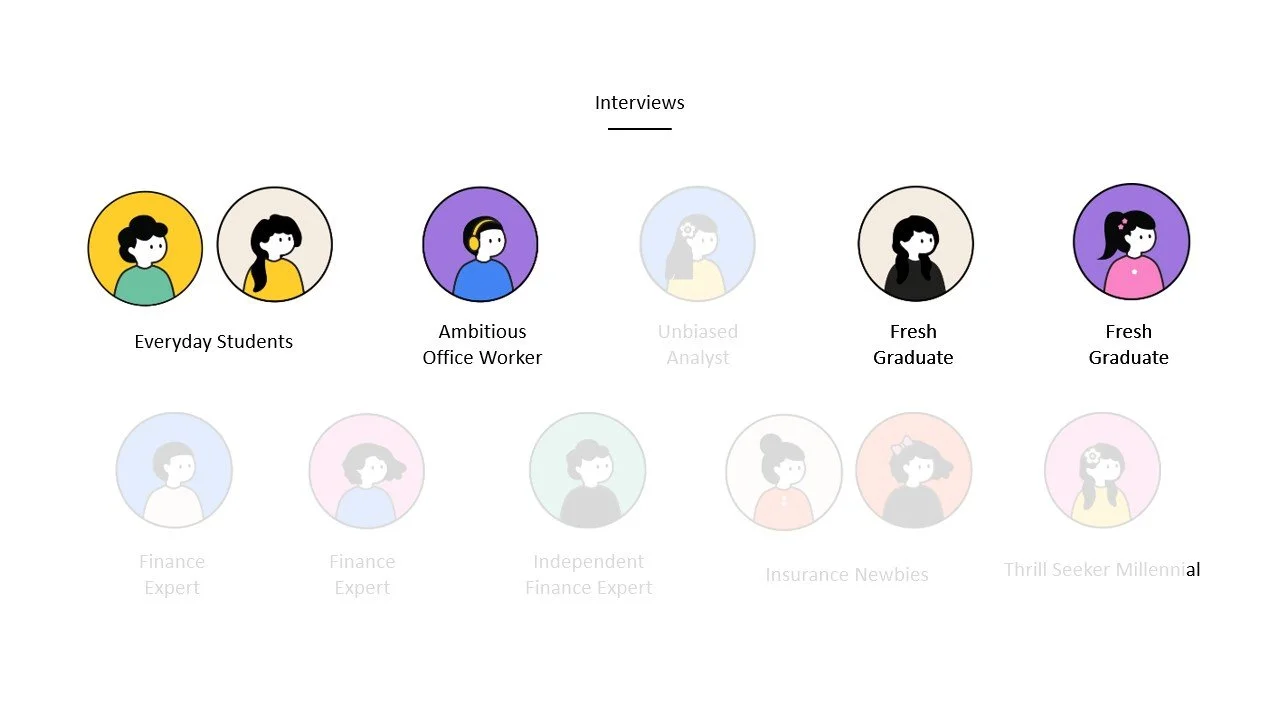

12 Interviews with 12 different personas

transcribed and analysed

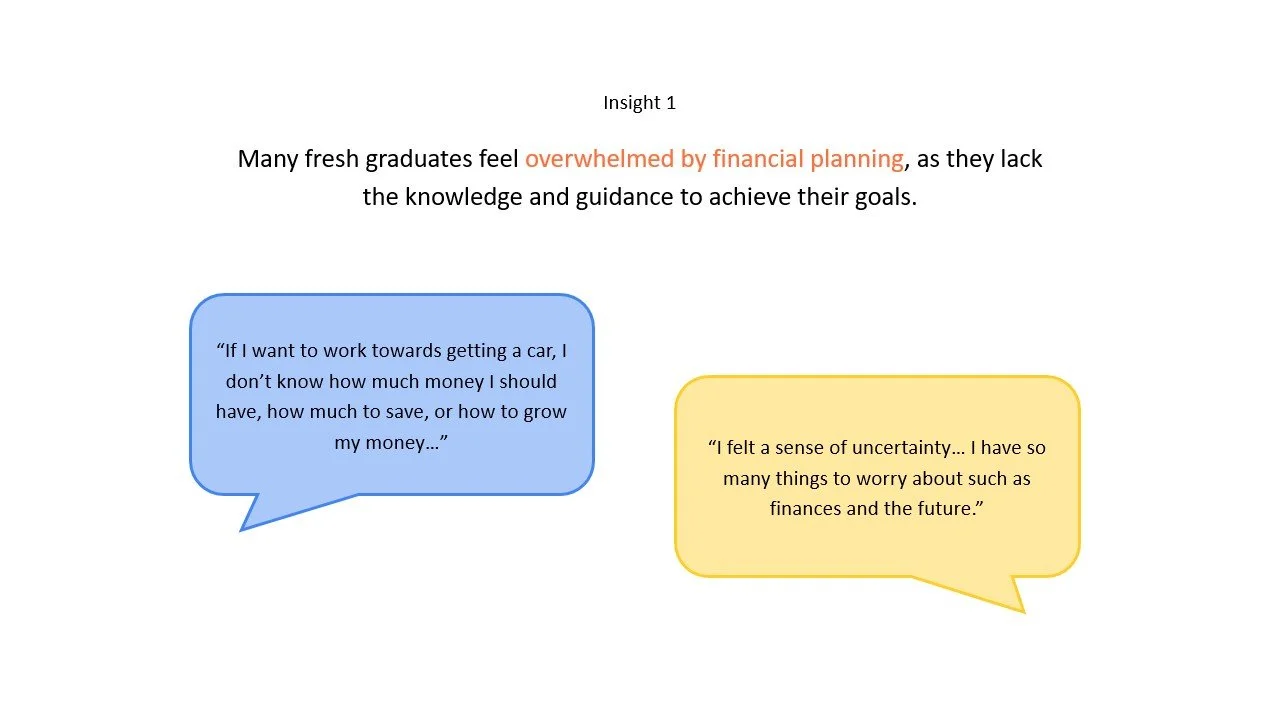

“If I want to work towards getting a car, I don’t know how much money I should have, how much to save, or how to grow my money…”

“I felt a sense of uncertainty… I have so many things to worry about such as finances and the future.”

“People around me started dying... then you realise its actually quite real sia when people tell you anything can happen, so insurance is very important”

“If I want to work towards getting a car, I don’t know how much money I should have, how much to save, or how to grow my money…” “I felt a sense of uncertainty… I have so many things to worry about such as finances and the future.” “People around me started dying... then you realise its actually quite real sia when people tell you anything can happen, so insurance is very important”

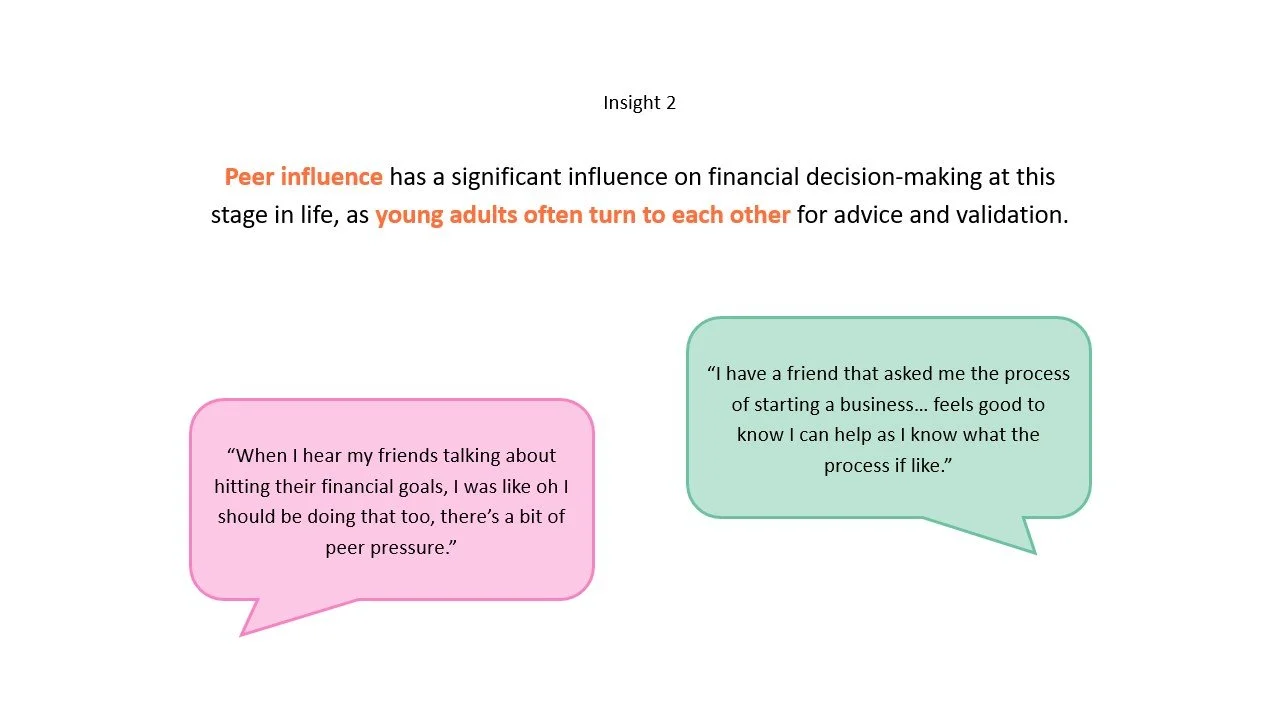

“I have a friend that asked me the process of starting a business… feels good to know I can help as I know what the process if like.”

“When I hear my friends talking about hitting their financial goals, I was like oh I should be doing that too, there’s a bit of peer pressure.”

“I have a friend that asked me the process of starting a business… feels good to know I can help as I know what the process if like.” “When I hear my friends talking about hitting their financial goals, I was like oh I should be doing that too, there’s a bit of peer pressure.”

“Its always good to just compare”

“I would start searching online but cuz idk what sites to trust”

“I don't have credible source to find out if I'm is doing the right thing. Trying to find info is not hard, the hardest part is trying to cross reference and trying to see if it's accurate.”

“Its always good to just compare” “I would start searching online but cuz idk what sites to trust” “I don't have credible source to find out if I'm is doing the right thing. Trying to find info is not hard, the hardest part is trying to cross reference and trying to see if it's accurate.”

2X Finance Experts

1X Independent Finance Expert

1X Ambitious Office Worker

1X Unbiased Analyst

6 Key Insights generated

2X Everyday Students

2X Fresh Graduates

2X Insurance Newbies

1X Thrill Seeker Millennial

People value human connection in the insurance process, appreciating the personalised experience and empathy from advisors, which builds trust and understanding beyond just the policies. Therefore, digital platforms will always take a secondary role to the need for emotional connection provided by human advisors in the insurance journey.

1

Importance of human touchpoint

Many valued having a human to speak to when learning about insurance because they are able to receive personalised advice. The FA is usually their first touchpoint in their insurance buying journey.

“For me i prefer everything to be face to face and have a person to guide me through”

“I would still prefer speaking an expert in person to clarify any questions”

Insurance is selling a service

Beyond simply selling insurance products, financial advisors are valued for the the care, sincerity, and support they offer in guiding and helping their clients.

“Instead of comparing products, people actually compare services”

“Are you a salesman or are you trying to help?”

“I feel talking to real people is easier, because you get to throw them questions and tell them scenarios. It's more curated and they can answer you better. Then get answers on the spot.”

People value personalised experiences

Many people emphasised the value of personalised feedback from a financial advisor, tailored to their unique circumstances and needs—something digital tools are unable to fully replicate.

People relate to stories

People tend to understand insurance better when it's explained through stories and real-life scenarios, as they find it easier to relate to.

“Its really stories that people relate to.”

“I will share with them about my own experience... So I tell them what are the things to look out for. I’m here to make their life easier.

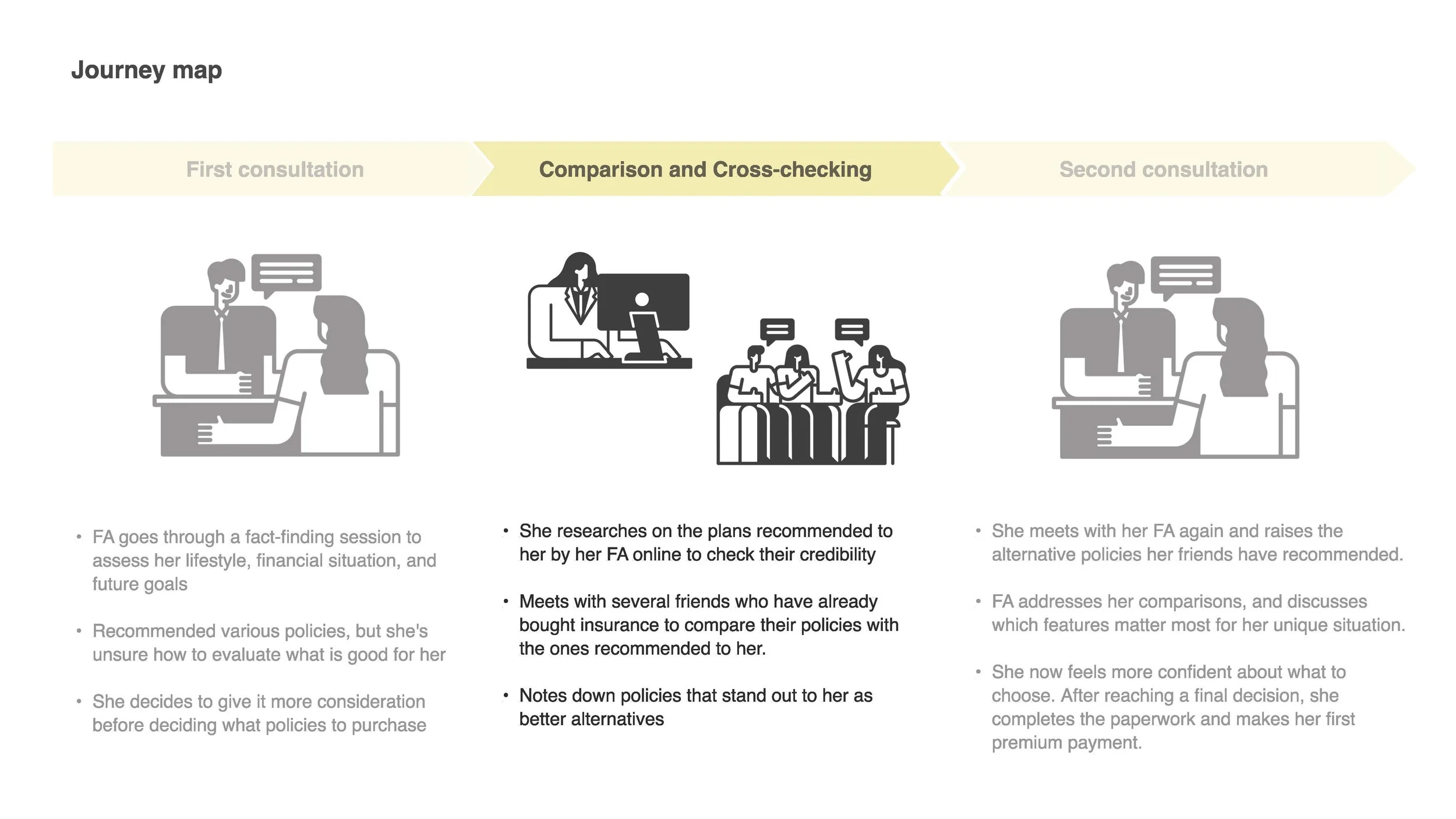

A lack of trust in FAs drives people to cross-check multiple sources to feel confident in their insurance decisions. However, these sources are often scarce, biased or difficult to trust, adding uncertainty to the process.

2

Lack of trust for FAs

There is a stigma that many believe in – FAs make

bold promises or are out to take advantage of the

less-informed for personal gains.

“Talk is cheap, they can say anything.”

“FA most likely, but theres a stigma that they want to leech off your money but some know what they’re doing — just trust that one”

Cross checking is necessary for decision making

Many people routinely cross-check information and conduct their own research in addition to consulting a financial advisor to ensure they are making informed decisions.

“I cannot just seek advice from one FA.”

“Its always good to just compare”

Younger individuals who have not witnessed or experienced critical life events fail to recognise the importance of insurance due to the lack of immediate relevance to their lives. Therefore, leading to missed opportunities to secure more affordable coverage when they're young and healthy.

3

Those who have experienced or witnessed critical events tend to recognise the importance of insurance

“People around me started dying... then you realise its actually quite real sia when people tell you anything can happen, so insurance is very important”

In contrast, younger individuals who haven't had such experiences often fail to see its value.

“Young customers most of the time tell me they healthy not interested in critical illness plan”

“I’ve never been in a super grave situation and seen how it can severely impact your life if you get insurance”

People are overwhelmed by the complexity of insurance and seek simpler and more direct processes in their journey. As a result, people may be discouraged from engaging with digital platforms that present detailed information without considering the audience's readiness.

4

Many find insurance difficult to navigate due to its complexity

Policies often involve detailed terms, conditions, and jargons that are confusing for the average person to understand.

“Some things are very technical, theres a lot of confusing terms so you need someone to explain to you”

“They will take out the ipad and start drawing lines and you’ll be like what is that?”

People don’t want complexity in

the insurance process

Many people prefer a straightforward insurance process, as added complexity only increases stress and uncertainty in an already important financial decision.

“My FA tried to show me stacking 3 different plans but end of day I just needed to know the end number, the rest I don't really need to know.”

“Goal is to minimise complexity in the claiming process.”

CompareFIRST is more catered to insurance savvy individuals

CompareFIRST is most helpful for those with a solid understanding of insurance or digital tools, while it is less accessible for individuals unfamiliar with insurance jargon or product details.

“The online tools are more to catered to another group of people, those who are more savvy, do not need people to service me”

“Goal is to minimise complexity in the claiming process.”

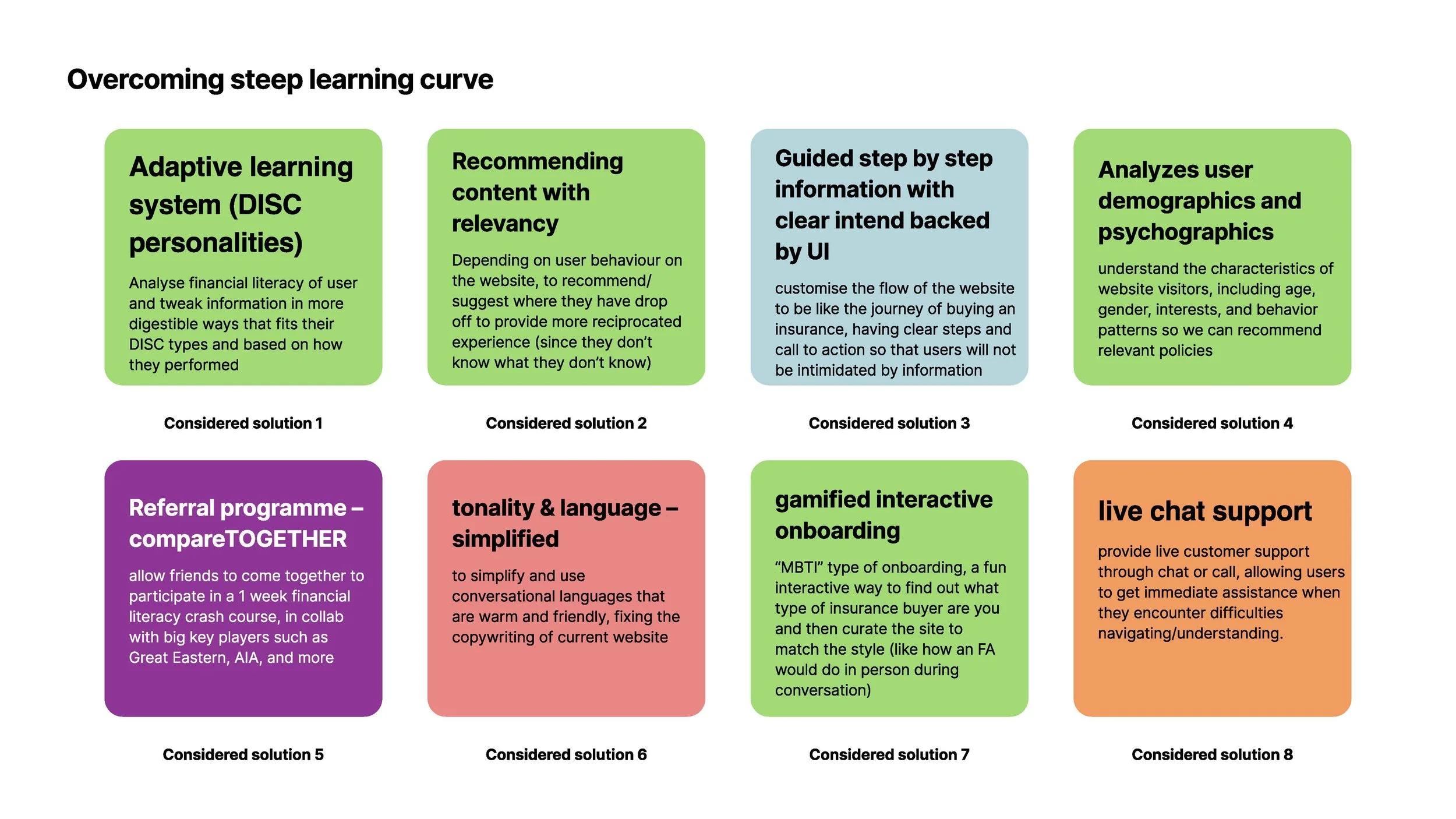

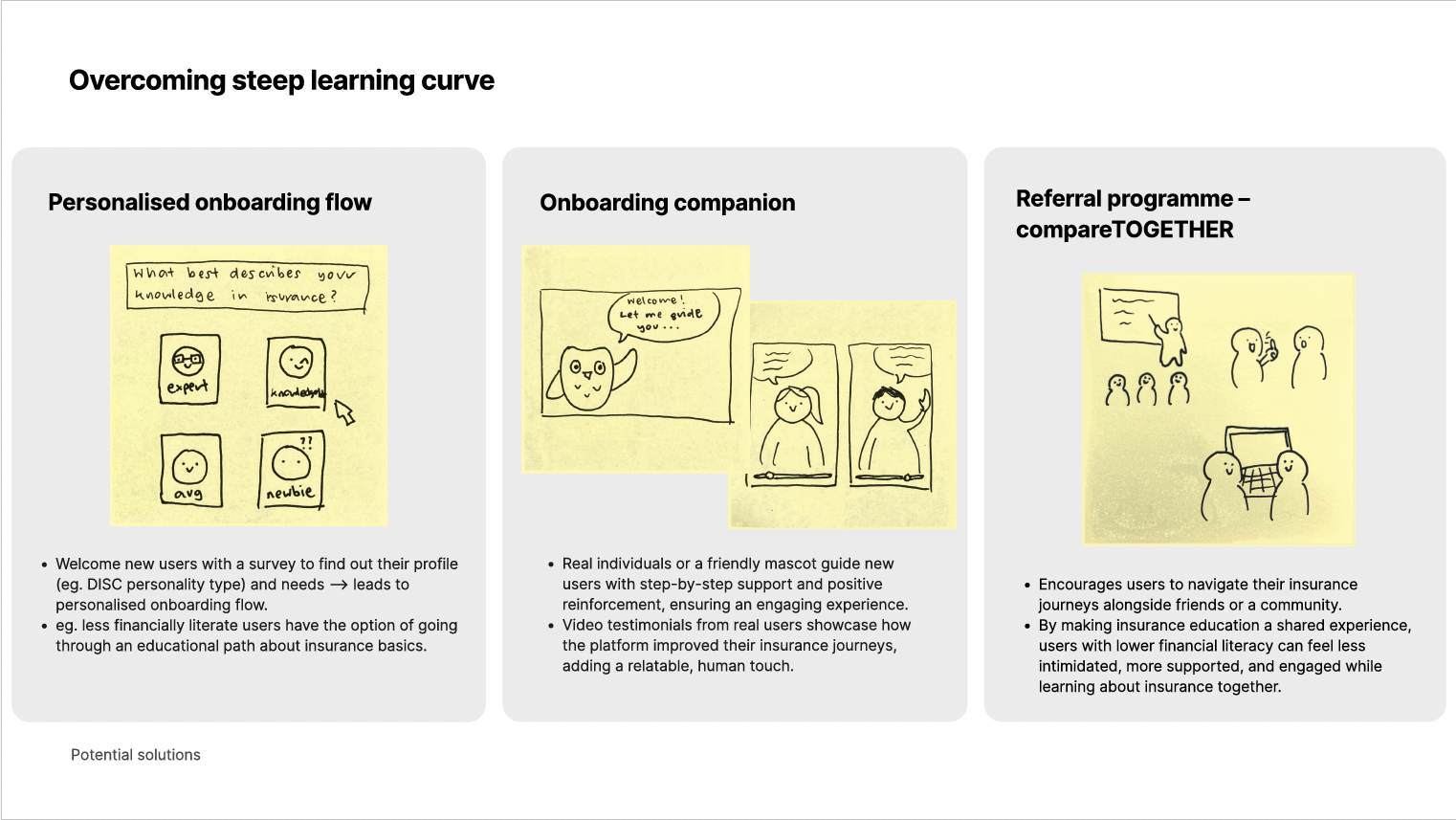

The steep learning curve and preconceived notions about insurance deter individuals with lower financial literacy from learning about it. This leaves them vulnerable to misconceptions and potential exploitation by financial advisors.

5

High barrier of entry for the less financially literate

Some expressed the inertia of starting to learn about insurance due to the overwhelming amount of information available and uncertainty about where to begin.

“it’s the inertia of starting because theres so much info, you don’t know who to trust, you don’t know where to start to look for proper info”

“I was paying a lot for my previous plan... Then when I met up with another FA I realised something was wrong so then I took the forfeit — maybe 1k to 2k I forfeited maybe 3⁄4 months of payment.”

Vulnerability to potential exploitation for those less knowledgable

People shared experiences of being taken advantage of and upsold policies by financial advisors when they lacked the knowledge to make informed decisions.

“If you're clueless they'll start selling you all the stuff and you don't know what are the correct questions to ask also.”

Misconceptions about insurance

Financial advisors highlighted numerous instances where people hold misconceptions about insurance, particularly for those who are less financial literate.

“People don’t read fine prints. Even if read fine prints also don’t understand”

“Far too many times those who are not financially educated think one plan can cover them for everything.”

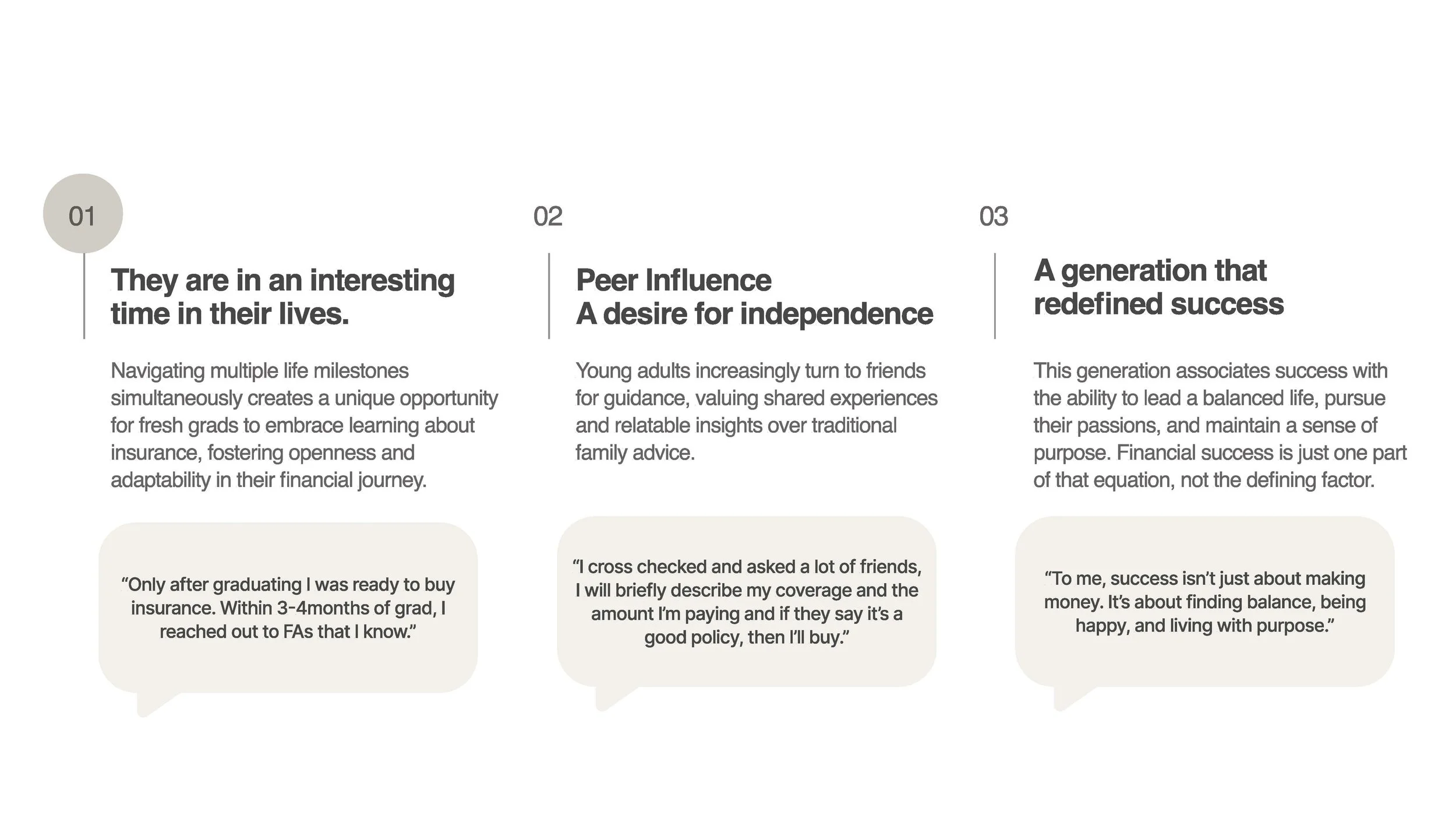

Some people tend to rely on their personal networks, such as family and friends, for insurance advice due to the inherent trust in these relationships. However, this can result in a lack of independent research, causing them to overlook potentially better policies available in the market.

6

People tend to trust their friends most when it comes

to insurance

Personal recommendations are viewed more reliable and unbiased compared to advice from financial advisors or online resources. Friends are seen as having firsthand experience and no vested interest, which makes their opinions feel more trustworthy and relatable.

“Also another reason why I buy insurance through my friend is that I can trust him that he will get me all the coverage that i need.”

“I think for us is like, part of it comes from when one of our friends also bought from the same guy, that gives us reassurance because other people did it”

“I don’t really go online and search for stuff because I trust that my peers will know me enough to recommend what is best for my current circumstances.”

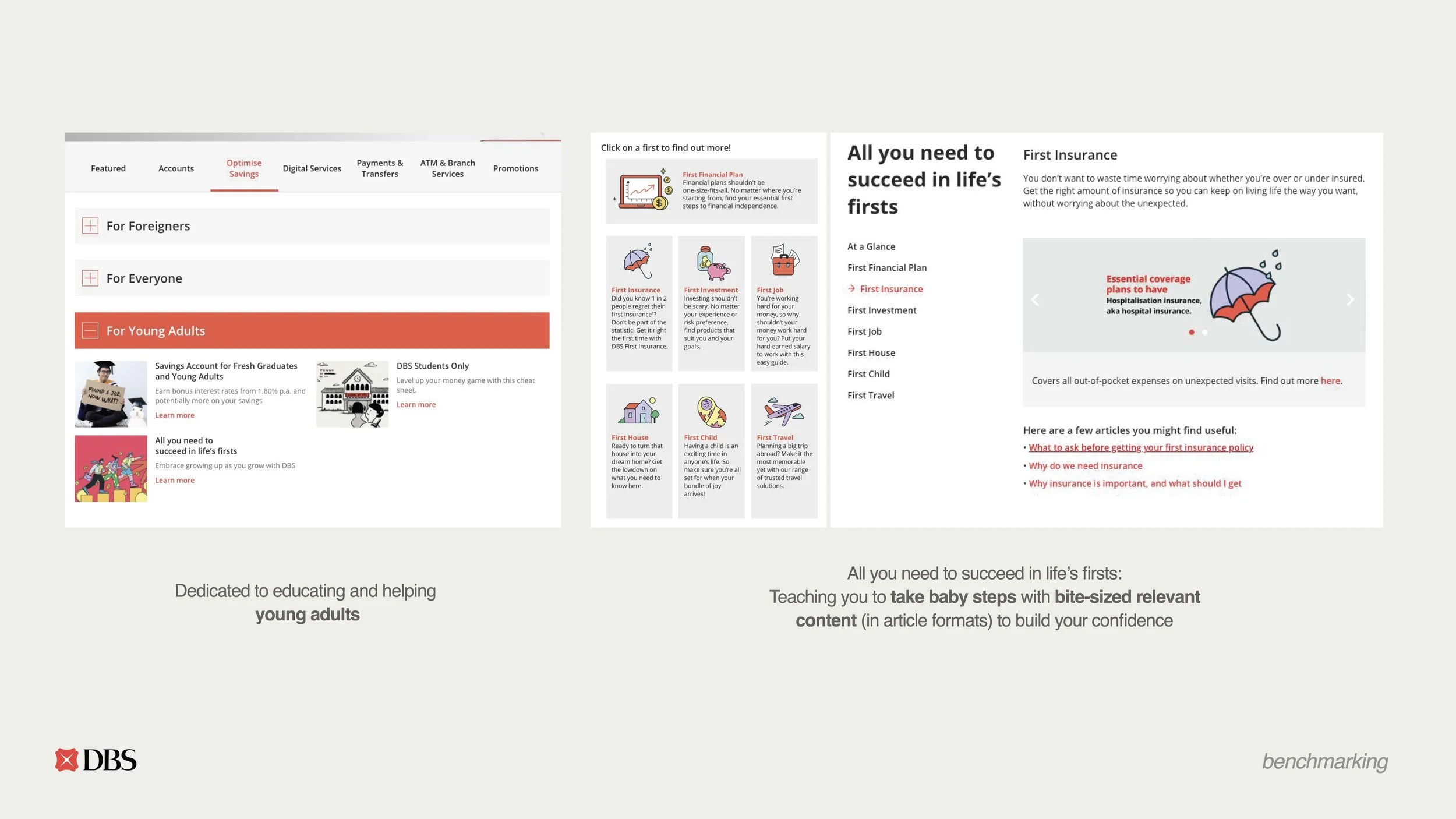

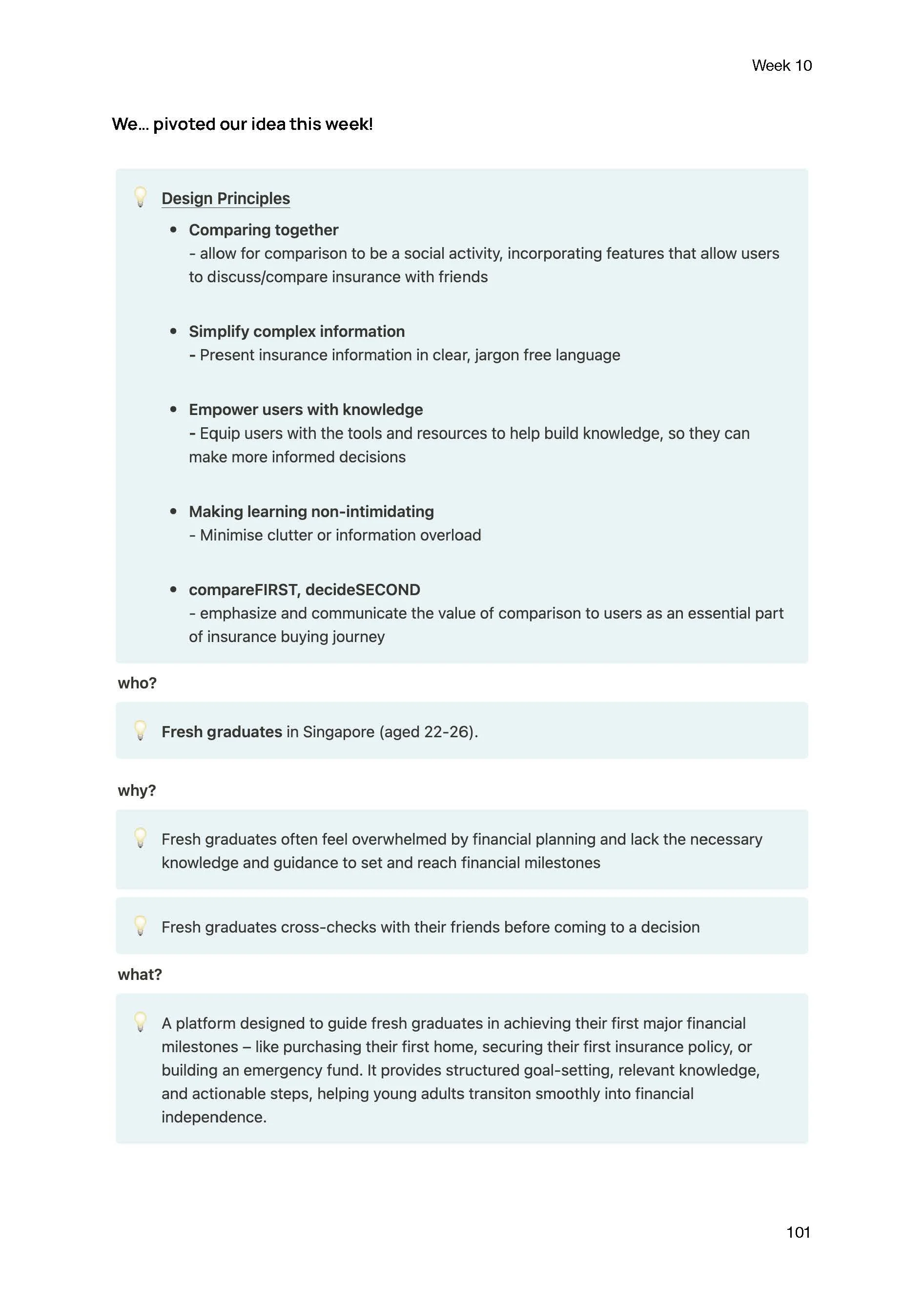

We narrowed our focus to

young adults

Young adults are money-minded, and driven by money in this economy.

- salary is the top concern for fresh grads

- studies hard for a better future (cash, assets, and knowledge rich)Very comfortable in this digital age

- unlike other gens, young adults grew up in an era where technology is not just a tool, but a lifestyle

- young adults leverages on digitalisation to self-educate, research, invest, and start businesseshowever, greatest barriers to investments are

- limited budget; not much assets to begin with

- fear of making losses, and misjudgement

- lack of investment knowledge; a new field to slowly self-educatecommon worries from fresh grads

- managing debts; student loans are expensive

- savings and investment knowledge; where to start, when to start, how to start?

- job security; is this job paying enough?

- society and peer pressure; constantly in a “competition”

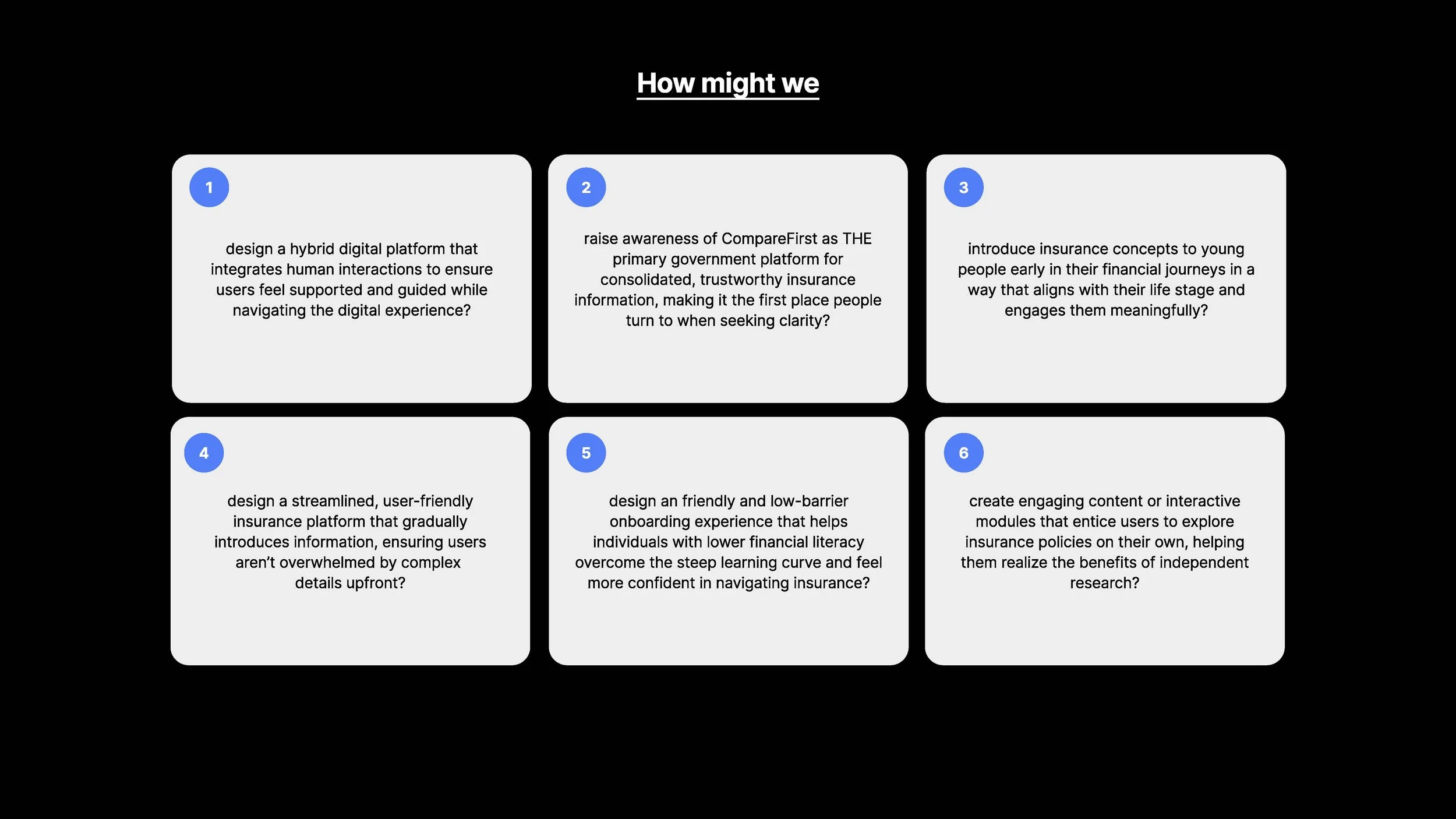

How Might We

help young adults feel guided and supported on their financial journeys?

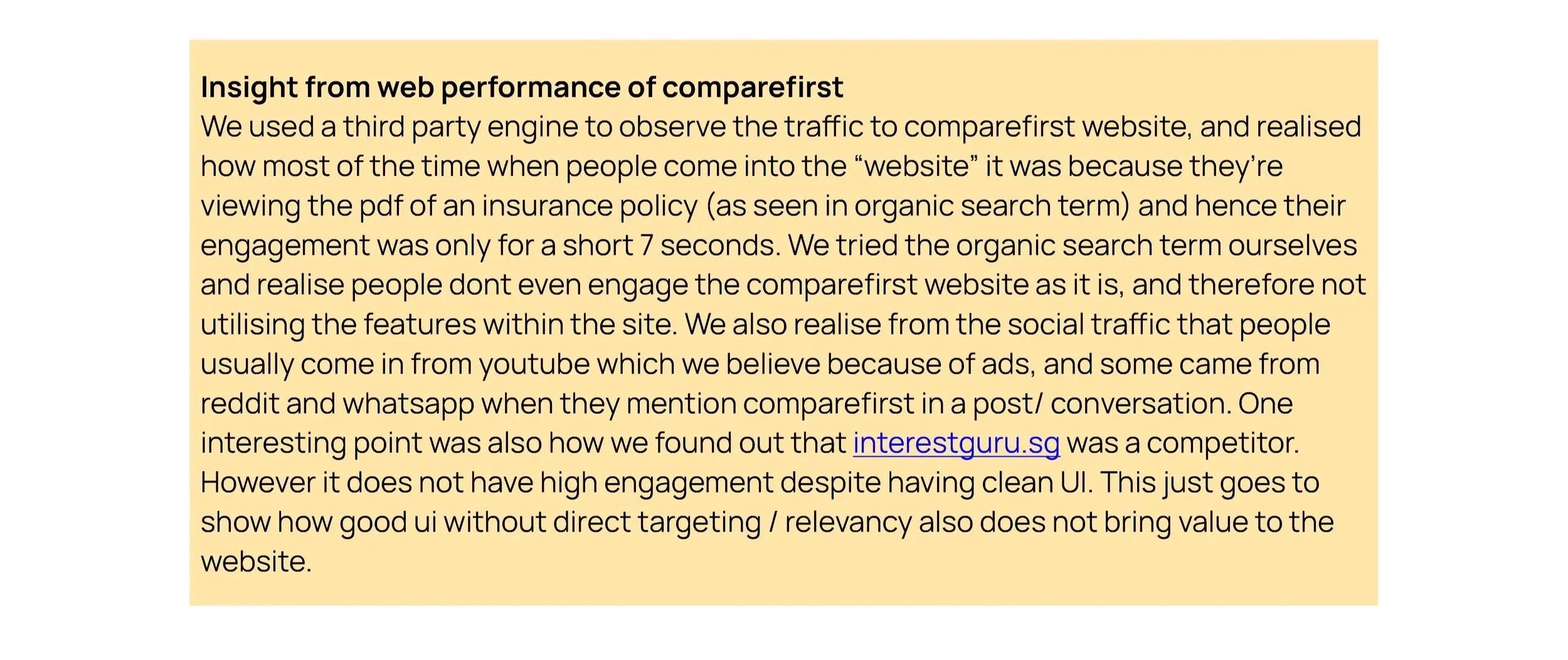

Interim feedbacks from MAS and why we chose to pivot

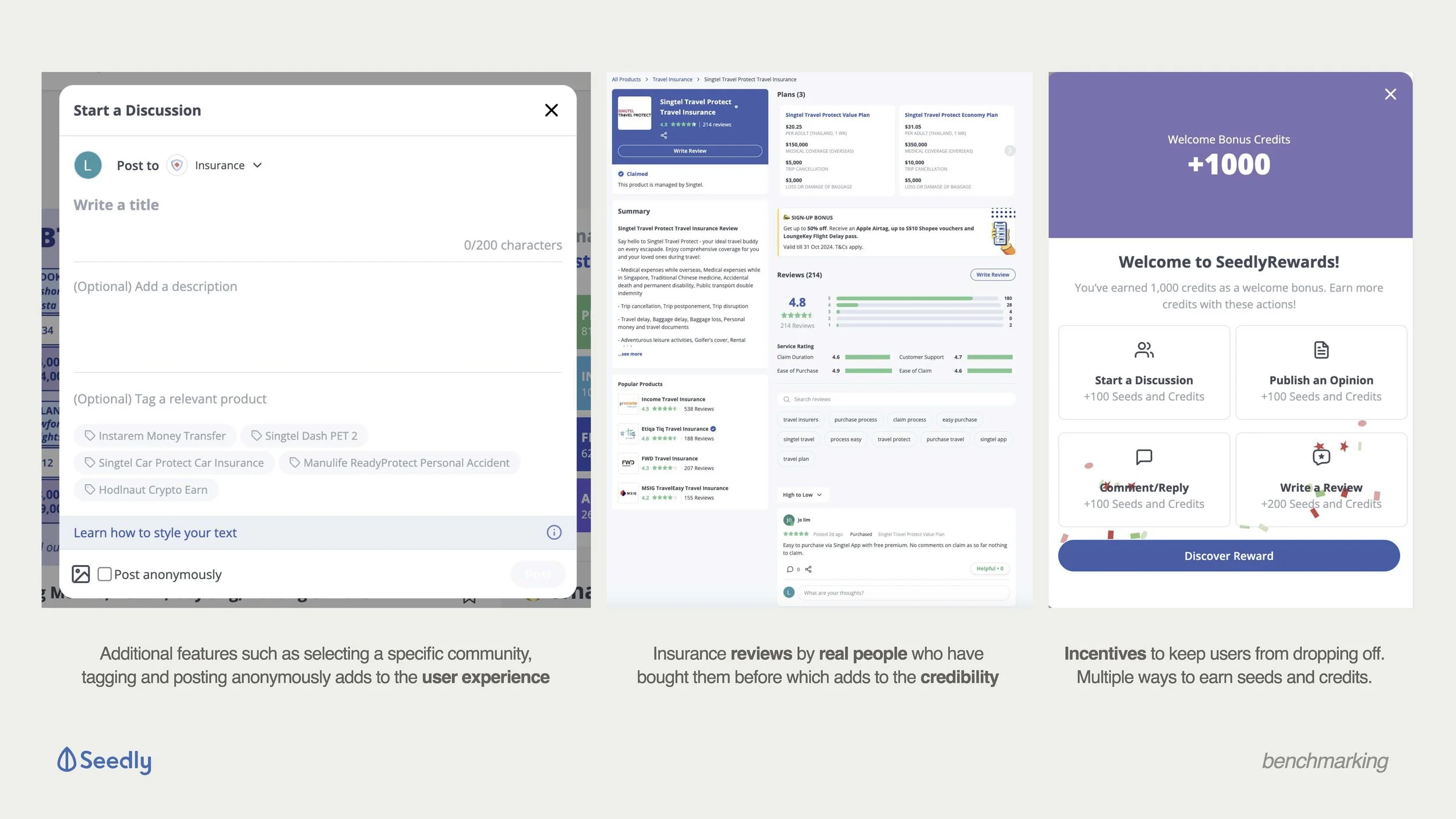

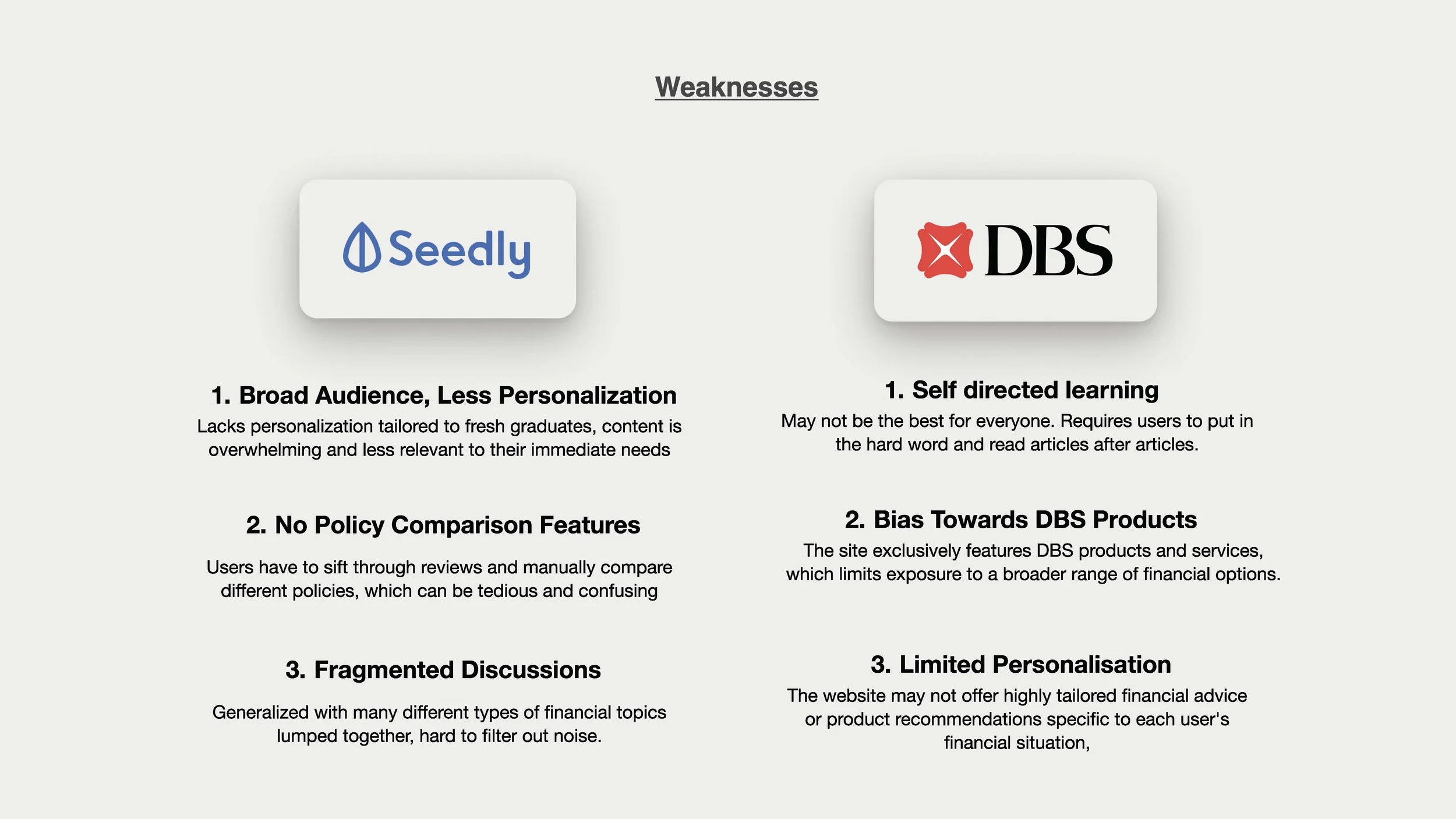

Validation of reviews and maintaining unbiased, factual information is crucial. Users need assurance that reviews are trustworthy, which may require authentication and moderation.

The platform should offer a balance of factual information and peer reviews without overwhelming users or becoming a "blind-leading-the-blind" situation.

Ensure the platform resonates with fresh graduates, offering an engaging, relatable experience. Avoid overly serious tones that could deter casual users, and consider touchpoints like the first paycheck moment for relevance.

Partnering with established brands like MoneySense or leveraging endorsements could enhance credibility. Establishing the platform as a safe, reliable space is essential for user trust.

Provide guidance on next steps post-research (e.g., contacting an FA or further reading). The platform should support informed decision-making, directing users to credible resources without direct recommendations.

Anonymity and information filtering options can ensure users feel comfortable sharing experiences while keeping the content relevant and manageable for other users.

Personal Reflection

People often say that choosing the right teammates can make or break a project—and after these 13 weeks, I couldn’t agree more. I still remember pulling the team together in Week 1, and honestly, if I had to do it all over again, I’d choose the same people without hesitation. We had great synergy, and I’m really grateful for how we supported one another throughout the journey.

When we first started, the three of us were total beginners when it came to insurance. I never imagined I’d enjoy learning about something I once found dry—finance, numbers, and long articles were never really my thing. But slowly, we got the hang of it. Interviewing 12 people from different backgrounds together was intense but incredibly eye-opening. Each conversation helped us refine our ideas bit by bit, with the hope that we could create something meaningful.

We also gained a lot from speaking to colleagues at MAS and from Ali’s thoughtful feedback during consultations—it really helped sharpen our thinking. Amidst the chaos, I found myself reflecting more on my own 'adulting' journey too... especially when it comes to managing finances and insurance (still working on it, I promise!).

Like any team, we had our ups and downs—disagreements, debates, and definitely some stressed-out nights. But I think those moments only reflected how much everyone cared. We genuinely wanted to give this our best shot, and that kept us going through all the late nights (and snacks).

Looking back, I’m really proud of what we’ve built together through Pathwise. I think the final outcome speaks to each of our strengths in UI/UX, and more importantly, our willingness to learn, adapt, and grow. I feel lucky to have gone through this with two amazing teammates who constantly pushed each other to do better.